A Blueprint to Restore Homeownership for Young Canadians

10 Recommendations for the Federal Government

This morning, the Missing Middle Initiative, with generous support from the Canadian Real Estate Association, released ‘A Blueprint to Restore Homeownership for Young Canadians’.

The full report can be downloaded at the bottom of the page.

Highlights

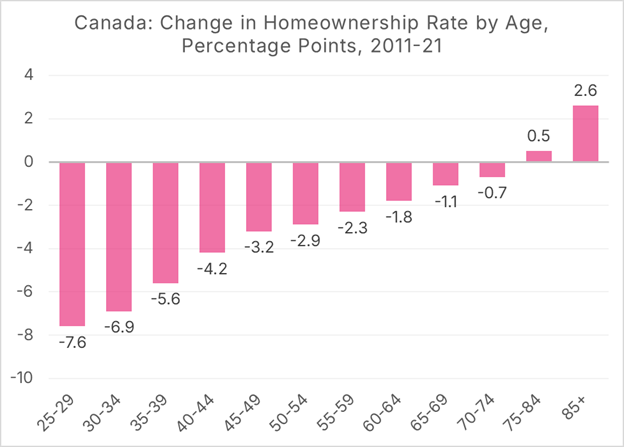

Homeownership is in substantial decline for young Canadians: Between 2011 and 2021, homeownership among 30–34-year-olds fell from 60% to 52%, and the decline is steepest in younger cohorts.

However, young Canadians still want to own, but their confidence is collapsing: While 86% of non-homeowners under 30 aspire to buy someday, only 51% respectively, feel confident they’ll ever get there.

Ownership supply is failing to keep up with population growth: A combination of rapid population growth, lacklustre construction of family-sized ownership homes, and investors buying up family-sized homes has created a shortage.

The federal government needs to adopt four goals: They should seek to scale up housing construction across the continuum, create ownership opportunities for renters, right-size housing for existing families and for seniors, and shift investor activity from buying existing homes to building new purpose-built rentals.

Ten actionable federal recommendations anchor the blueprint: These recommendations include a national housing secretariat; annual start targets by unit size and tenure; an ACLP stream for 2–4 unit “missing middle” builds; direct-to-buyer development charge billing and HST/GST reforms to remove “tax-on-tax”; down-payment assistance plus inflation-indexing HBP/FHSA limits; a time-limited expanded GST/HST new housing rebate; a seniors housing strategy; and a MURB-style tax provision paired with incentives to sell investor-held homes back to families and reinvest in new rental construction.

Rebuilding the pathway to homeownership

Young Canadians are increasingly seeing homeownership as out of reach. While 86% of non-homeowners under 30 and 75% of non-homeowners between 30 and 44 still aspire to own a home one day, only 51% and 47%, respectively, are very or somewhat confident they will achieve this goal. The combination of higher interest rates, stagnant wages, and a two-decade-long increase in price-to-income ratios has made it increasingly difficult for them to qualify for a mortgage. Their ambition has turned into uncertainty, and for many, that uncertainty is turning into defeat. The issue is not willingness to buy, but rather whether they can afford to enter the market at all.

Despite softening rental market conditions in 2025, affordable units remain high in demand, and the average rent for 2-bedroom units climbed 5.1% year-over-year. High monthly rents make it more challenging for renters to save up for a down payment, and today’s increasingly high cost of owning a home requires buyers to save increasingly larger down payments. Over the past two decades, as home prices have risen, young people have experienced the phenomenon of “the more I save, the further behind I fall”, as required down payments have grown faster than their savings. Ironically, in many cases, their monthly rent is as high, if not higher, than their monthly mortgage payments would be, but the inability to save for a down payment makes the transition from renting to owning a home nearly impossible.

While policies that directly assist first-time buyers are necessary, governments need to adopt a more comprehensive approach to the problem and recognize that housing is a complex system. For example, policies that increase rental supply can reduce rents, making it easier for existing renters to save for a down payment on a first home and freeing up a unit for another tenant. Policies that enable seniors to downsize and growing families to upsize can help right-size the market, freeing up units for the next generation of homebuyers.

The decline in homeownership has been particularly acute for younger Canadians; from 2011 to 2021, homeownership rates among 30-to-34-year-olds plunged 7 percentage points, from almost 60% to just over 52%.

Addressing root causes

To rebuild Canada’s pathway to homeownership, we must understand the factors that have priced young Canadians out of buying their first home. The pathway to homeownership as we know it was created by Canadians, for Canadians, with the creation of the CMHC in 1946 to finance new home construction, expand access to mortgages, and help the country rebuild following a wartime shortage of homes. Today, many factors are at play, with the following four identified as being particularly important:

· Housing starts have not kept up with population growth.

· There has been a shift towards building fewer family-sized homes.

· There has been a reduction in housing starts intended for the ownership market. In particular, entry-level and ‘missing-middle’ housing is in short supply.

· Investors have purchased a large number of homes intended for owner-occupancy to meet the surging demand for rentals.

The federal government must address these problems while respecting the division of powers, working within its fiscal constraints, meeting its lofty supply goals, and avoiding overstimulating demand for existing homes, thereby allowing price-to-income ratios to return to more attainable levels. While these proposed reforms help address the pressures that have priced out a generation of would-be homeowners, more must be done if we are to reopen and restore the pathway to ownership for future generations of Canadians.

Over the past decade, the federal government has enacted several reforms, including the National Housing Strategy and changes to mortgage amortization, and has promised further changes, such as the still-anticipated Multiple Unit Residential Building (MURB) tax provision and the creation of Build Canada Homes. While these proposed reforms will move Canada closer to restoring the dream of homeownership, more needs to be done to achieve this goal.

Canada needs a blueprint to restore a pathway to homeownership, not just for young Canadians, but one that creates opportunity for middle-class families and seniors who are stuck in a system with nowhere to move. To succeed, the blueprint must be practical, grounded in federal realities, and focused on four clear, measurable goals:

Build homes for real families: Scale up construction across the housing continuum to increase the attainable supply of both rental and ownership housing options that meet the needs of families of all shapes and sizes.

Rebuild the pathway to home ownership: Make it easier for renters to become first-time buyers by simplifying the process of saving for a down payment and by creating programs that enable renters to transition into ownership options without increasing their monthly housing expenses.

Right-size housing for existing families: Make it easier for existing homeowners, particularly young families and seniors, to transition into “right-sized” housing, thereby unlocking existing homes for first-time buyers.

Shift the market from portfolios to families: Reverse the trend of family-sized homes being purchased by investors by shifting investment activity into building new purpose-built rental housing.

It will take a suite of federal policies to meet these objectives, with provincial and municipal governments also playing key roles in execution, zoning reform, and unlocking supply on the ground. This will require a coordinated, sustained effort at all levels of government to build public understanding and ensure that supply meets Canadians’ needs. playing key roles. With that in mind, the next step is implementing straightforward, actionable change that will restore the pathway to homeownership for Canadians.

Our ten recommendations

Recommendation 1: To ensure housing is attainable for all Canadians, establish a permanent mechanism to collaborate and coordinate housing policy and development, such as a national housing secretariat.

Recommendation 2: To ensure new home construction keeps pace with population growth, the federal government should introduce annual housing start targets that are broken down into unit size and ownership type, make these available to provinces and municipalities to aid with planning, and update these targets in response to changes in immigration targets and other policies that impact population growth. These housing start targets should also be used to ensure that Build Canada Homes creates homes that meet the diverse needs of Canadian families, including a range of unit sizes and both rental and ownership options.

Recommendation 3: To increase the supply of missing middle housing, create an application stream in the CMHC’s Apartment Construction Loan Program (ACLP) for smaller builders who wish to build 2-4 unit buildings or require loans less than $1 million in size.

Recommendation 4: Substantially lower the price of new homes for Canadian families by removing tens of thousands of dollars of interest costs, junk fees, and tax-on-tax from the cost of new homes by implementing a transparent direct-to-buyer development charge (DC) billing model that exempts DCs from HST.

Recommendation 5: To ensure that young Canadians can purchase their first home, introduce a federal downpayment assistance program for first-time homebuyers.

Recommendation 6: To ensure that young Canadians can save enough for a down payment for their first home, the federal government should index the Home Buyers’ Plan and First Home Savings Account contribution limits and lifetime contribution limits to inflation.

Recommendation 7: Substantially lower the price of new homes for Canadian families through a temporary three-year expansion of the existing GST/HST New Housing Rebate to provide a rebate of 100% of the GST on new homes valued up to $1 million, and a partial rebate for homes between $1 million and $1.5 million, but otherwise keeping the existing rebate criteria in place.

Recommendation 8: To help seniors downsize and unlock family-sized homes for the next generation of Canadian families, develop a federal housing strategy for seniors to build desirable housing options and diverse typologies that enable aging seniors to remain in their communities.

Recommendation 9: To build much-needed missing-middle rental housing, and to channel investor dollars towards new construction and away from competing with families and buying up single-family homes, launch consultations on the proposed Multi-Unit Rental Building (MURB) tax provision this spring, with the goal of ensuring that rental projects that begin construction on or after January 1, 2027, are eligible for the tax provision.

Recommendation 10: To get single-family homes out of the hands of investors and back into the hands of families, create a time-limited incentive for investors who currently own non-purpose-built rental properties who sell the units to non-investors and reinvest the proceeds into a project eligible for the MURB tax provision.

These reforms, along with other initiatives implemented or introduced by all three levels of government, can help reverse the decline in homeownership rates since 2011 and restore a pathway to homeownership. Governments must ensure home prices return to attainable levels while enabling income growth for Canadian families.

A PDF of the full report is available at the link below:

Some good ideas here, but I’d suggest three things.

First, we should reduce the social expectation that home ownership is required for a happy life, and stop conflating “home ownership” with having a home. There are many benefits to this logical paradigm shift.

Second, any initiative that makes ownership “more affordable” by helping people pay today’s high (or tomorrow’s higher) prices should be treated very carefully. That doesn’t let the market adjust naturally; it just adds another block to the stack holds and pushed prices up.

Third, we need to target the non-housing demand pressures, especially policies and incentives that make housing attractive as an investment for capital appreciation. That’s how we got here. That’s how the market for housing got separated from the need for housing: it was financialized. Buying a house can’t be a primary way to build a nest egg. That requires, as a base minimum mandatory requirement, that housing prices rise faster than inflation and, almost certainly, faster than incomes. It’s built in. This is the structural element we are not dealing with and that guarantees failure.

Many of today’s fixes for the “housing crisis” do not address the underlying issues, some of which have been building since the 1940s. And, it seems, many put a lot of faith in an structurally distorted market to sort things out with a bit of re-balancing.

This initiative’s myopic advocacy continues to detract from proven solutions to housing affordability at a critical moment in Canada’s history.

Canada’s total fertility rate is just 1.26. If we don’t raise that number within the next few years, Canadians will need to make a choice between record breaking immigration, year after year—or population decline that harms our economy, our productivity, and our ability to maintain a standing army. To avoid that choice, it’s imperative we raise our TFR before Millenials and Gen Z fully embrace childlessness, as Gen X and Millennials in Japan and South Korea have done in the recent past.

The missing middle solution won’t move the needle the TFR for many reasons, but most importantly because it is not the type of housing young people most desire. Single family homes are. Stop reinventing the wheel, and look back at our history.

In the 1940s we built single family homes for an inflation-adjusted price of $25K. How? We built them to a lower standard. 1 bathroom. Minimal electrical. No basement (most were built on cedar blocks). Minimal insulation. If there was an inspection, there was not a second one. They were built in 4 days per home. The new owners hand dug the basements and added foundations later. Most of these houses are still housing families in Montreal today, although heavily adapted by their owners over time to suit their needs and budgets. That’s a strength of SFHs.

Human beings in poverty have been building single family homes for themselves from stone, clay brick, and wood for hundreds of years on this continent that are still providing a place to raise families in. It’s not survivorship bias, look around Canada’s oldest cities.

Only in the past 80-some years have we slowly regulated and taxed our natural right and building legacy out of existence.

Now guess what? We have a shortage 80-some years in the making and nation-wide population aging.

Missing middle housing isn’t going to solve the population aging in rural Canada where the infrastructure for multifamily housing doesn’t exist.

The only strategy we need right now is a strategy to restore property rights so houses can be built affordably. Slash regulations and taxes, in favour of insurance requirements. Get rid of the efficiency standards. Incentives to improve insulation are already on the heating bill. Stop pretending that people will build knob and tube and use asbestos if we cut the building code—the incentives to use better technology are already plentiful.

Every regulation your org has advocated for acts as a tax on young home buyers. Every tax on young home buyers delays first home purchase and family formation. Is driving down Canada’s TFR really the legacy you want?

Canada’s priorities need to be:

1. Having a future generation.

2. Providing an improved standard of living for the next generation.

Your priorities are backwards.