Canada Risks Losing 100,000 Housing Jobs as Starts Collapse

A step-by-step breakdown of how housing math becomes a jobs crisis

Highlights

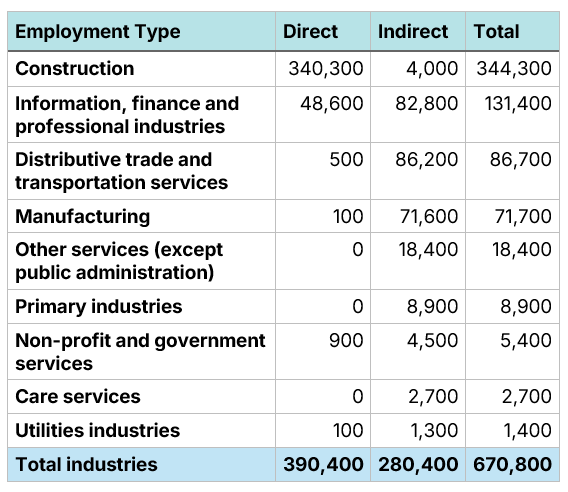

Statistics Canada estimates that there were 670,000 jobs generated from housing employment in 2024, with 390,000 of those being direct jobs, and 280,000 being indirect, such as the manufacturing of products used in housing construction.

Due to declining economic conditions, the CMHC estimates that housing starts will fall by roughly 30,000 units between 2024 and 2027.

If that decline in starts were to occur, it could lead to as many as 100,000 jobs lost.

This job loss would not occur all at once, but would be staggered over time, due to the nature of housing construction.

A prolonged employment reduction would cause skilled labour to leave the sector, making it even more difficult for Canada to hit ambitious housing targets.

When 15,000 automotive manufacturing jobs were at risk after the financial crisis, governments acted aggressively. Given that Canada needs more homes, we need to see all three orders of government take bold steps to reverse the slide in housing starts and pre-construction sales.

Falling housing construction has economy-wide impacts

In July 2025, the CMHC released housing start projections indicating that housing starts will decline each year through 2027, resulting in a loss of tens of thousands of homes. This not only puts us further away from the goal of doubling housing starts, but it would also result in the loss of approximately 100,000 jobs across Canada. A job loss of that magnitude would cause substantial damage to the Canadian economy, but also make it harder for the country to hit its housing targets in the future, as many of those workers would permanently leave the industry, just as my father did in the 1970s, becoming a high-school shop teacher.

Here’s the math behind that estimate.

Translating housing starts and sales into jobs

Statistics Canada estimates that, in 2024, there were 1.2 million jobs associated with housing construction across Canada. This includes 670,000 jobs related to new housing construction, 470,000 homes associated with renovations, and 72,000 jobs associated with “ownership transfer costs”, involving transactions of new homes between two or more parties.

Not all of these are direct jobs in construction. Of the 670,000 jobs associated with new residential construction, roughly 40% are indirect jobs, including the manufacturing and shipping of housing-related materials.

Figure 1: Number of jobs related to new residential construction, 2024

Data Source: Statistics Canada Table 36-10-0679-01. Chart Source: MMI

There were roughly 250,000 housing starts in Canada in 2024, with 150,000 apartment units and 100,000 ground-oriented homes. If we divide the 670,800 jobs over those 250,000 starts, we find that each home generates roughly 2.7 person-years of employment.

This 2.7 estimate is an average, with some homes being more labour-intensive to build than others. Altus Group has estimated that each ground-oriented home is associated with 3.8 person-years of employment, and each apartment unit generates 1.5 person-years of jobs. These would appear to be conservative estimates, as those parameters would lead to 605,000 jobs under our 150,000 apartment/100,000 ground-oriented scenario, well under Statistics Canada’s estimate of 670,800 homes.

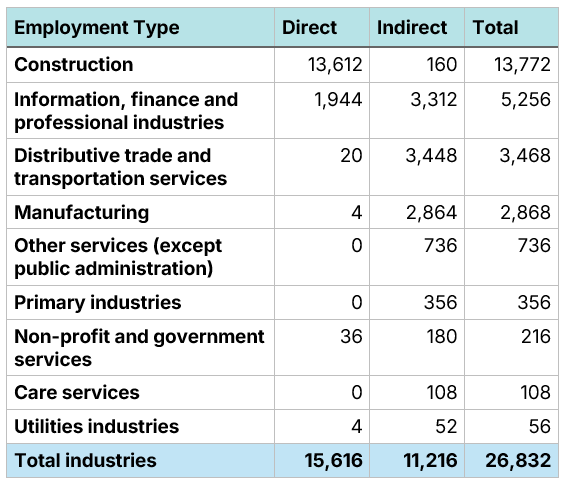

If we use the Statistics Canada values, we can estimate the amount of person-years of employment lost from a 4%, or 10,000 unit reduction in housing starts (or pre-construction housing sales), 6,000 of which are apartment units, and 4,000 of which are ground-oriented homes. This slowdown in housing starts (or pre-construction sales) would lead to a loss of 26,832 jobs.

Figure 2: Estimated job loss from a 10,000 unit reduction in housing starts or pre-construction housing sales, assuming a 6,000 apartment / 4,000 ground-oriented split.

Data Source: Statistics Canada Table 36-10-0679-01. Chart Source: MMI.

It is important to note that employment loss from a drop in housing starts or pre-construction sales does not happen all at once, nor does it occur at the same time. An apartment unit start in 2025 will lead to the employment of elevator mechanics in 2026 or 2027. Pre-construction apartment sales have even longer employment lags, as that elevator mechanic may not work on that building until the end of the decade. But the employment losses associated with a drop in housing starts or pre-construction sales, while often delayed, are very much real, and challenging to reverse when they happen.

The July 2025 CMHC projection shows that housing starts, in their “alternate” scenario, fall to just 212,500 units in 2027, a reduction of 33,000 units relative to 2024 levels. A reduction of this magnitude would lead to an employment reduction of 75,000 to 100,000 jobs per year, depending on how those reductions are split between ground-oriented homes and condos. And that’s assuming the outlook does not deteriorate further; CMHC revised their 2027 housing projections downward by 13,000 units between their February and July forecasts.

A loss of 100,000 jobs across Canada would be a substantial hit to our economy and the well-being of tens of thousands of families. When 15,000 jobs were at risk in the automotive sector after the 2008 financial crisis, federal and provincial governments understood the devastating impact this would have and acted aggressively to protect the sector.

The federal government, along with several provinces, have committed to doubling housing starts, but bricks do not lay themselves. If the industry continues to bleed jobs, these promises are little more than political theatre. The loss of 100,000 jobs would impact families and communities in the same manner as a factory closure. Reversing the housing start slide and ensuring that skilled workers don’t leave the industry forever is not just an economic necessity; it’s the only way those housing pledges stand a chance of becoming reality.

Download a PDF of this article here: