Countervailing Tariffs Could Add Over $1B a Year to the Cost of Homebuilding

We do the math so you don't have to

Highlights

In response to the Trump Administration’s trade war and the unwarranted and unreasonable tariffs on Canadian goods, Canada is placing countervailing tariffs on made-in-America goods, which could impact the cost of homebuilding in Canada.

We identify 85 different products, from insulation to appliances, that are crucial in the construction of a new home.

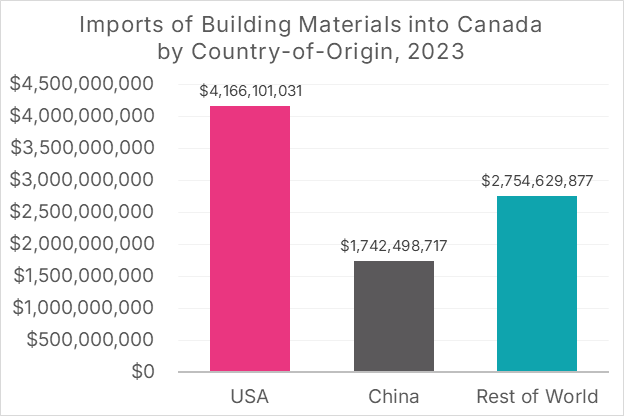

In 2023, Canada imported 8.7 billion USD (12.4 billion CAD, assuming a 70-cent dollar) worth of these products. Of these imports, 48% were made in the United States (4.2 billion USD), 20% were made in China (1.7 billion USD), and 32% were made in the rest of the world (2.8 billion USD).

Canadian importers paid 81M USD on these products last year, with 65M of that from products made in China. Because of the Canada-United States-Mexico Agreement, all American products that met the eligibility criteria came in duty-free.

If Canada adds a 25% countervailing tariff on all US goods, the tariffs paid on these goods will increase by 1B USD (1.5B CAD), assuming no changes in price or trade patterns.

In many cases, “buying Canadian” is not a way to avoid these tariffs, either because there are no made-in-Canada alternatives or because critical components of products like drywall that are manufactured in Canada are made in the United States.

Policymakers have a number of options to address this rise in costs, including exempting construction materials from countervailing tariffs, eliminating tariffs on construction materials from non-US countries, and lowering other housing-related taxes, such as development charges.

Over the last month, the most frequent question we’ve received here at the Missing Middle is, “How will the Trump Administration’s unwarranted and unprecedented trade war on Canada impact housing construction?” Our response had been to largely look at the macro factors. As the trade war weakens the economy and unemployment rises, families are less likely to want (or be able to) purchase a new home, causing housing starts to fall even further, a point made by Douglas Porter at BMO. Once the economy recovers, the period of underbuilding will cause prices and rents to spike in some markets.

That’s the 30,000-foot story. But there is an important on-the-ground story to tell about housing inputs and the impact of Canada’s countervailing tariffs on American-made building materials.

It takes a lot of imports to build a home

In a letter to the federal government, Brad Jones of Wesgroup identifies 121 different products, by tariff code, that are inputs to building a new home: everything from insulation to lighting fixtures. Using the World Bank’s World Integrated Trade Solution, we tracked down 85 of these goods at the HS6 product level. Here is what we found.

The United States, not China, is Canada’s biggest source of housing construction-related imports

Of the 85 goods on our list, there are 57 where Canada imports more from the United States than from China. In 2023, Canada imported 4.2B USD of made-in-America housing inputs, 1.7B USD of made-in-China goods, and 2.7B USD of goods made elsewhere. The World Bank data is in US dollars and is based on where the good was manufactured, so a Chinese-made washing machine that is shipped to Los Angeles and makes its way to Vancouver via train counts as an import from China, not from the United States.

Figure 1. Imports of Building Materials into Canada by Country-of-Origin, 2023

Source: World Integrated Trade Solution

These products mostly come in tariff-free… for now

In 2023, Canadian importers paid 81M in tariffs on these products, with the majority (65M) coming from made-in-China products. That year, none of the made-in-America products were subject to tariffs (so long as they met the rules-of-origin requirements) thanks to Canada’s trade deal with the United States and Mexico.

Source: World Integrated Trade Solution

However, this is likely to change. In response to the Trump Administration’s trade war, Canada has announced a 25% tariff on $30 billion worth of imports from the United States, and another 25% tariff will be placed on another $125 billion of American imports. The list of candidate goods for future tariffs has been announced, and it contains many inputs to homebuilding. Currently, there is a comment period that runs until April 2nd, during which stakeholders can inform the federal government of the impact of these tariffs and potentially have some taken off the list.

If the entire list of made-in-America housing inputs were subject to a 25% tariff, the annual tax would be over 1B USD, or 1.5B CAD, assuming a 70-cent loonie. Of course, Canadian importers may be able to respond by importing products made in other countries, but this is not often feasible and can be prohibitively expensive.

Hopefully, the federal government will understand the negative impact that tariffs on construction inputs will have on Canada’s housing crisis and remove them from the final list.

Buying made-in-Canada products does not exempt us from tariffs

Builders may be able to find made-in-Canada substitutes for some of these inputs. However, those goods may still be impacted by countervailing tariffs due to Canada-US supply chains. This is well known in the automotive sector, where components are made from parts from dozens of suppliers in both Canada and the United States.

Figure 3: Supply Chain in Rear Suspension Assembly

Source: We Make Things Together

The same complex supply chains apply to the components of a home. If you’re building a house in Ontario, the drywall that you will use was likely manufactured in Canada. However, the face paper and backing paper of that drywall was almost certainly manufactured in the United States. As such, if Canada’s federal government places a countervailing tariff on that paper, it will raise drywall prices in Ontario, even though that drywall is a made-in-Canada product.

Other options than exemptions exist, but they’re far less direct

There are other things that governments could do to blunt the impact of countervailing tariffs on the homebuilding industry. One is to eliminate tariffs on products coming from other countries, such as China. This could help diversify supply chains, though the cost savings (81M USD a year in tariffs paid to the federal government) are pretty minimal. Another could be for governments to lower other taxes, such as development charges. In the longer run, we will likely see supply chains re-organize, with more products (and components) sourced either in Canada or with more reliable trading partners like the European Union. Until then, the federal government should tread cautiously with countervailing tariffs as they threaten to worsen Canada’s housing crisis.

Download a PDF version of this article below:

Download an Excel Sheet with data on the 85 product categories below: