Failing Grades, Falling Starts: Ontario Housing’s Bleak Mid-Year Checkup

A new report from MMI and RESCON

Earlier this summer, RESCON approached the Missing Middle Initiative to conduct an analysis of the state of new housing in Ontario. This led us to release the first of a series of quarterly report cards. The full report, Q2 2025 GTA and GGH Housing Report Card: Starts, Sales, and Employment, authored by Jesse Helmer, can be downloaded at the bottom of the page.

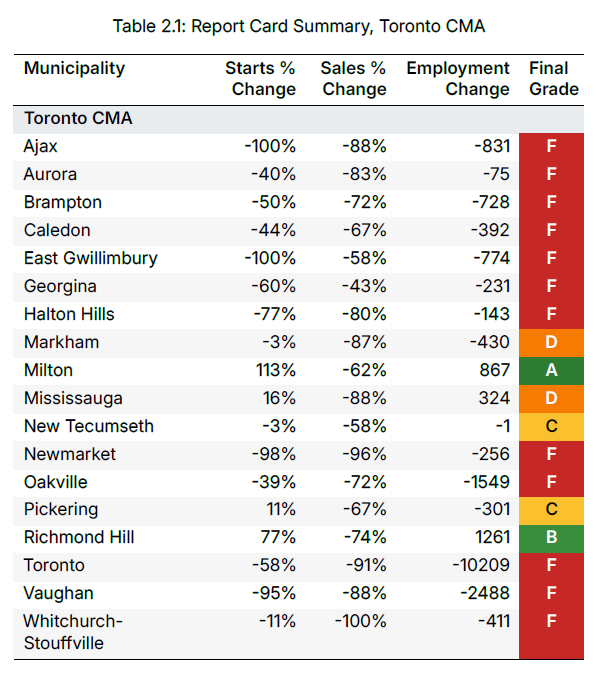

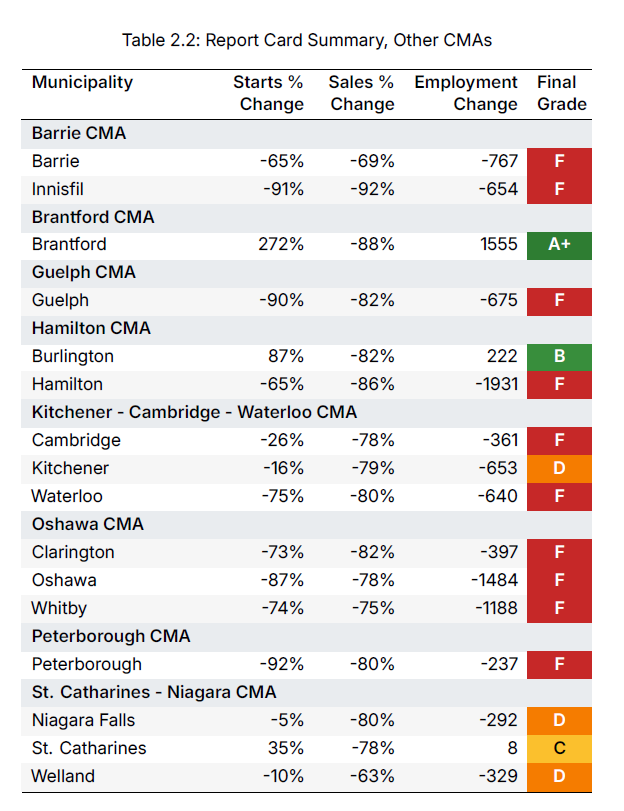

Our assessment, based on data obtained from the CMHC and the Altus Group, is bleak. We examine 34 separate municipalities across nine separate metro areas in the Greater Toronto Area and Greater Golden Horseshoe region, and assess the state of housing sales and construction over the first six months of the year, relative to the first six months of the previous four years (2021-24).

In the first six months of the year, housing starts are down 40% in those 34 municipalities. Condo apartment starts over the past six months are down 54% relative to 2021-24 January-June averages, and purpose-built rental starts are up 8%. Ground-oriented housing (everything other than apartments) starts are down 42%, showing that the region’s housing weakness is not just a condo-market story.

The reduction in housing starts has economic ramifications. On average, it takes 3.8 years of employment to build a ground-oriented home, and 1.5 years to build an apartment unit. The reduction in housing starts, over the first six months of the year, relative to 2021-24 averages, translates into 24,195 fewer person-years of employment.

Unfortunately, things are going to get worse before they get better. Housing starts are a lagging indicator, as the CMHC only considers a unit to be “started” when a building’s foundation is 100% complete, so it often reflects the market decisions of several years prior, when the decision to build was made. Pre-construction housing sales are a better indicator of the market’s current health and are indicative of future housing starts.

Across our 34 municipalities, pre-construction sales of condo apartments are down 89%, and pre-construction ground-oriented sales are down 70%. This is a clear indication that Ontario’s housing situation will get worse before it gets better, and that market weakness is not isolated to the condo market.

Each of our 34 municipalities was assessed across five categories, three reflecting starts (ground-oriented, condo apartments, rental apartments) and two reflecting sales (ground-oriented, condo apartments), and given a grade; see the methodology section for details.

For our 34 municipalities, 22 received an F, and another 5 received a D. While the other seven (7) municipalities received a C or higher, much of that was based on unusually strong housing starts, rather than robust pre-construction sales. Because starts are a lagging indicator, we expect average grades to fall before they rise.

The state of housing construction in the GTA and GGH should alarm policymakers across all three orders of government.

To download the full report, click on the link below: