How the $55B ACLP Housing Program Might Actually Make Money

Why rental builders line up for ACLP and why taxpayers aren’t footing a $55B bill.

Highlights

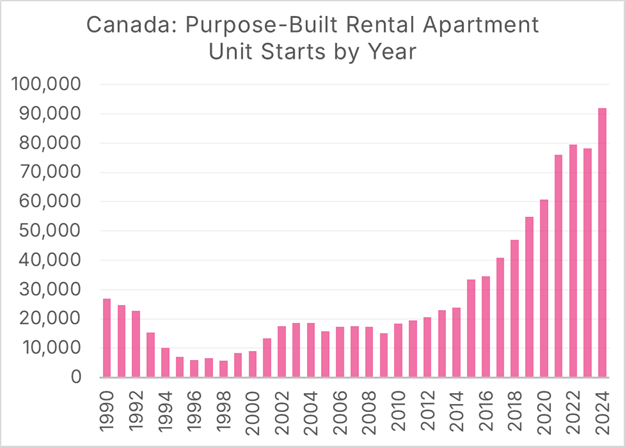

Canada is in the middle of a rental-construction boom: Purpose-built rental starts have been rising sharply over the last decade, driven in large part by federal policy.

The Apartment Construction Loan Program (ACLP) is the central engine of this boom: The program offers low-cost, insured financing to developers who commit to affordability.

Despite a headline figure of $55 billion, ACLP is not a $55-billion “spending program”: ACLP offers repayable loans, and the federal government earns interest on them.

Budget 2025 pegs the ACLP’s annual fiscal cost at roughly $500 million, but this does not reflect the true cost: The federal government’s budgetary framework for loans prices in “concessionary terms”, that is, the gap between ACLP rates and full market rates, and not the government’s real cost of borrowing or administering the program.

The actual net cost of ACLP remains opaque, but available evidence suggests it may be a revenue-positive program: Greater transparency on true borrowing costs, concessionary terms, and default risks would allow proper assessments of cost-effectiveness across housing policies.

The policies behind Canada’s rental apartment construction boom

One of the least heralded housing success stories of the last decade has been the massive growth in the number of rental apartment units built or currently under construction across Canada.

Figure 1: Purpose-built rental apartment starts, number of units by year, Canada

Data Source: CMHC. Chart Source: MMI.

Federal policies, including the removal of GST on purpose-built rental construction, have played a critical role in this resurgence. The most transformative of these policies has been the CMHC’s Apartment Construction Loan Program (ACLP), which provides low-interest loans to apartment developers who agree to conditions, including a minimum proportion of affordable units. A recent release highlights critical facts about the program:

The $55 billion Apartment Construction Loan Program (ACLP) is providing low-cost financing to support more than 131,000 new rental homes across Canada by 2031 – 2032.

The ACLP provides stable supply of purpose-built rental housing is essential for more people in Canada to have access to housing that meets their needs.

As of June 2025, CMHC has committed $24.9 billion in loans through ACLP to support the creation of more than 63,500 rental homes.

The federal government is occasionally criticized for spending $55 billion on a program that mostly funds the construction of market-rate rental apartments. Of course, framing it this way is misleading, since the program provides loans that are repaid with interest. So the net cost to the federal government is nowhere near $55 billion.

But what does the program actually cost? That would be helpful to know, so we can determine how cost-effective the program is relative to other housing policies. Unfortunately, the answer to that question is more complicated than it appears.

What is ACLP, anyway?

The CMHC’s ACLP Program Highlight Sheet describes the program as follows:

CMHC Apartment Construction Loan Program (ACLP) provides low-cost funding to eligible borrowers during the most risky phases of development (construction through to stabilized operations). The ACLP includes CMHC mortgage loan insurance as an integrated feature of the program and provides access to preferred interest rates, lowering bowering costs for the financing of multi-unit residential properties and facilitates renewals.

Projects that qualify for funding under the ACLP will benefit from attractive financing options and underwriting flexibilities.

The program has an affordability requirement, with the standard option requiring that at least 20% of the units be affordable (defined as rents at or below 30% of the median total income of all families in the subject market) for at least 10 years.

The concept behind the program is that the CMHC provides the rental developer with lower interest rates and less expensive mortgage loan insurance than they could otherwise obtain, and in exchange, the developer builds affordable units they might not otherwise build, as well as buildings that meet higher social and environmental standards. A well-designed ACLP program should increase both the number of affordable housing units and market-rate units by leveraging the federal government’s ability to borrow at low cost.

Unfortunately, there is not a great deal of transparency on the interest rate actually charged on these loans, with the highlight sheet describing the rate as follows:

Applications will be qualified with an interest that is the higher of 2.00% or the CMHC indicative 10-year fixed rate plus a 100 bps (1.00%) spread. Note that the spread is determined by CMHC and is subject to change from time to time.

The CMHC does not provide details on what its “indicative 10-year fixed rate” is, though it is likely in the ballpark of the government’s 10-year bond yield, currently at 3.2%, which would mean that applications would be qualified at an interest rate of 4.2%. There is no question that developers are receiving a deal that is lower than what they could get in the open market; otherwise, they would not bother to apply, given the time, expense, and affordability requirements for successful applications.

The lack of information about the program makes it difficult for an outsider to cost. Luckily, the recent federal budget can provide some answers.

Pricing a concessionary term

The federal government’s new, and much heralded, Capital Budgeting Framework was introduced in the recent Budget 2025, and has the following goals:

This framework helps distinguish day-to-day operational spending from capital investment (broadly defined as spending that supports capital formation), allowing the government to identify and prioritise initiatives that deliver long-term economic returns. The framework also increases transparency, allowing Canadians to better understand what funds services today, and what builds future prosperity.

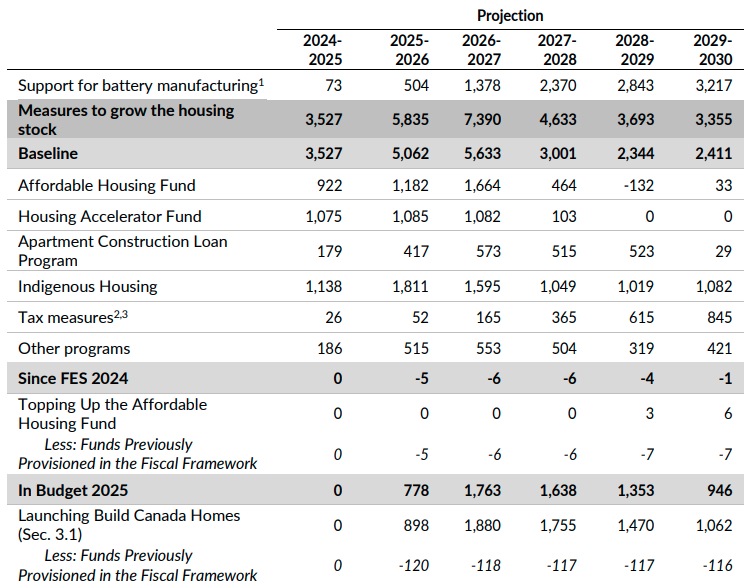

This increased transparency is very useful for our question, as the new framework pegs the annual cost of ACLP at roughly $500 million.

Figure 2: Capital investment details for measures that grow the housing stock, annual fiscal cost accrual method

Source: Budget 2025

Given that these loans are provided to developers at an interest rate above the government’s cost of capital, the annual fiscal cost of $500 million seems quite high. The relatively high figure can be explained by the types of costs the government includes in their cost calculation, as described on page 286 of the Budget:

Consistent with the presentation of the federal budget, under the Capital Budgeting Framework projected costs of capital investments are determined on a full accrual basis of accounting. Using a consistent basis of accounting makes it easier to understand how changes in capital investments impact the budgetary balance, and promotes comparability…

For example, under accrual accounting, the cost (cash basis) of acquiring federal land, buildings, equipment and other capital property, like bridges is capitalised, recorded as an asset and, except for land, amortised to expense (accrual basis) over the useful life of the capital property. For loans, cash impacts reflect the disbursement and repayment of loans, whereas accrual costs reflect allowances recorded to reflect concessionary terms and collectability and risk of loss. (emphasis added)

The phrase “concessionary terms” is vital to explaining the projected fiscal cost of ACLP under Budget 2025. The interest revenue generated by the ACLP loans is not assessed against the cost of government borrowing; rather, it is assessed against the amount of revenue the federal government could have generated on those loans if it had charged full-market rates. In other words, it is a function of the extent to which construction of these apartments is subsidized (relative to market loans), not the cost to the federal government of running the program.

Consider this simplified hypothetical example. A developer receives a $100 million ACLP loan, and the federal government funds it by issuing a bond. The relevant interest rates in our hypothetical example are as follows:

Government cost of borrowing: 3%

ACLP interest rate: 4%

Market interest rate 6%

On a $100 million loan, the government would make $1 million in net profit from interest each year, as they would receive $4 million in interest from the developer ($100M * 4%) but pay $3 million in bond interest ($100M * 3%). This is a profitable loan for the government, at least before administration costs and allowances for potential non-repayment.

However, since our accounting method takes into account “concessionary terms”, the ACLP interest rate is measured relative to the market interest rate. The government still receives $4 million in interest from the developer, but at an opportunity cost of $6 million, which is what they could have gotten if they charged market interest rates. That $1 million in profit is now booked as a $2 million annual loss because the government’s accrual method measures the subsidy's size rather than the true cost to the government.

Knowing the size of the subsidy, relative to market-based loans, is useful, and we are grateful that the federal government is providing this information. However, it would also be useful to know how much this program is actually costing the government, in terms of the interest they are paying relative to the interest they are collecting, as well as the operational costs of running the program and the expected losses from loan non-payment.

We suspect that if the government provided this information transparently, we would find that the ACLP program is a net revenue generator for the federal government. We hope future reporting on loan-based programs breaks out the annual details as follows:

Fiscal cost of operating the program, before concessionary terms and collectability and risk of loss.

Size of concessionary terms.

Provision for collectability and risk of loss.

This would give analysts the information we need to properly assess the relative merits of housing programs and provide a true indication of their actual costs.

So, to answer the question originally posed by this piece… we really don’t know the true cost of the ACLP program. But what we do know is that it is not $55 billion.