Development Charges have Helped Price Out the Middle Class

Welcome to the First Installment of Development Charge Deep Dive Day

Development Charges on a two-bedroom apartment in Toronto are currently at $80,690 a home and rising at 16.7% a year. This level of punitive taxation is simply incompatible with middle-class affordability and Canada’s commitment to treat housing as a human right. In our first installment of Development Charge Deep Dive Day, we explain why.

The day we launched the Missing Middle Initiative, we set out the following vision for the country:

Missing Middle Initiative’s North Star: Every middle-class individual or family in Canada should have a high-quality of life and access to both market-rate rental and market-rate ownership housing options that are affordable, adequate, suitable, resilient, and climate-friendly in every city in Canada.

When examining the definitions underlying the terms in the North Star, it quickly becomes apparent how far away we are from this vision, particularly in the City of Toronto. Consider a couple with a pre-tax income of $72,000 a year ($6,000 a month), with a small child living in Toronto. Their income, by the definition used by economists, would classify them as middle-class. To meet this North Star, they would need to:

Have access to both market-rate rental and market-rate ownership options

Have those options cost under $1,800 a month (to meet the 30% affordability threshold, as $1,800 is 30% of $6,000) to meet the affordability criteria. Note that the $1,800 a month includes not just mortgage (or rent) but also includes utilities, property taxes, condo fees and the like.

Have at least two bedrooms to be considered suitable.

There are very few rental options in the city that meet these options (while also being adequate, resilient, and climate-friendly). And ownership options? Forget it. The maximum price a property can be while keeping monthly shelter expenses under $1,800 a month will depend on interest rates, property taxes, and condo fees, but even with a 20% downpayment, anything over $300,000 would likely push us over the $1,800 a month threshold. Over $250,000 is pushing it unless both interest rates and condo fees are particularly low.

We defy anyone to find a 2-bedroom condo in the City of Toronto for $250,000.

One (of many) reasons why condos in Toronto are so expensive is due to an alphabet soup of municipal fees, including development charges. BILD’s 2024 Greater Toronto Area Municipal Benchmarking Study, prepared by Altus Group, found that City of Toronto charges alone for a high-rise apartment are over $130,000 a home. This figure represents all municipal charges and is based on an average of 1-bedroom 650 sq. ft. units and 2-bedroom 750 sq. ft. units.

Source: BILD.

There is simply no pathway to affordability for this family when the most they can afford for a home is $250,000, and over half of that is eaten up by municipal taxes on development alone. And it is the home buyer who ultimately pays for these taxes, as they are input costs in building a home and are fundamentally no different than the cost of a sheet of drywall or an hour of an electrician’s time. And since these costs are embedded into the final price, the home buyer pays GST, PST, and land transfer taxes on top of these municipal fees. A tax-on-a-tax.

The largest municipal fee is development charges, a revenue tool that Ontario cities use to fund infrastructure. Future pieces will discuss the mechanics of development charges in detail, but first, we need to understand that these charges are high and skyrocketing.

In the early 2000s, these charges were only a few thousand dollars per home in the City of Toronto. Today, they are over $80,000 per home for a two-bedroom apartment (though they are discounted to $48,299 for a purpose-built rental apartment).

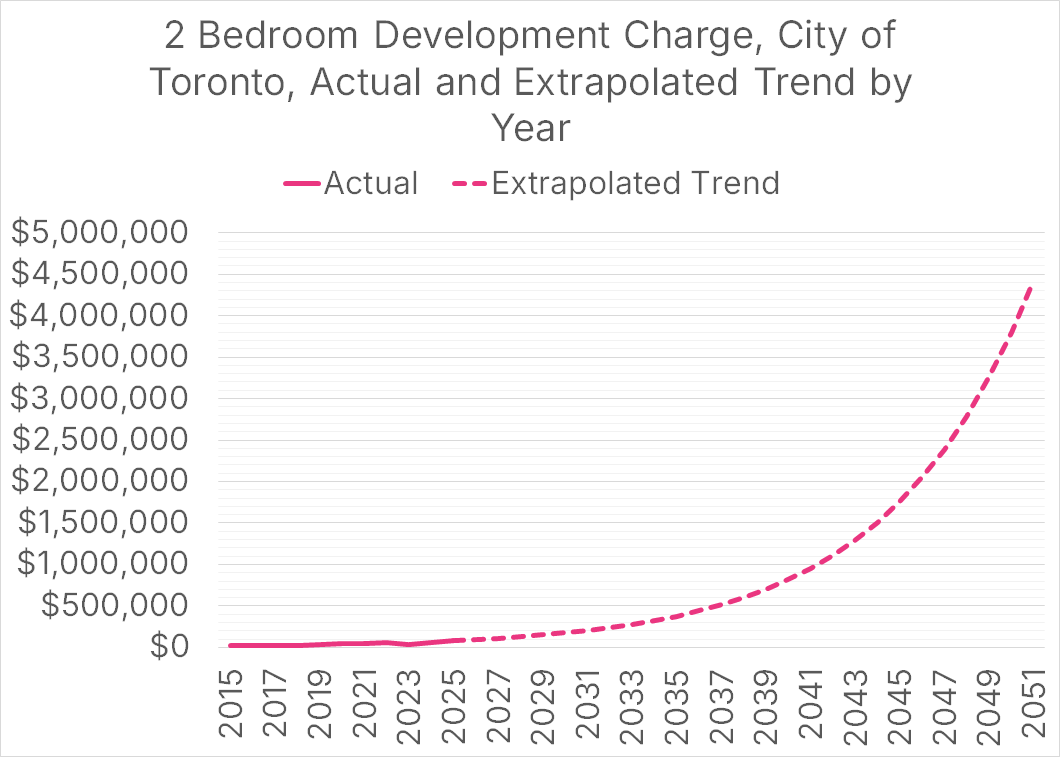

Much of this increase has occurred over the last decade. From January 1, 2015, to January 1, 2025, they have grown from approximately $17,000 to $81,000. That’s growth of 367% over 10 years, or about 16.7% per year. This is substantially higher than inflation, which has averaged 2.2% a year over this period. This means that development charges double about every four years, while prices in the rest of the economy double every 32 years.

Source: MMI Calculation.

When inflation appears to be heading above 3% a year, the Bank of Canada is required, as part of its agreement with the federal government, to take the necessary measures to prevent this. This is because both institutions have the objective “to promote the economic and financial well-being of Canadians,” and they recognize that “the best way monetary policy can achieve this goal is by maintaining a low and stable inflation environment.”

Unfortunately, Ontario municipalities like Toronto fail to recognize the importance of low and stable inflation to the economic and financial well-being of Canadians when they increase development taxes on households by an average of 16% a year, each year for a decade.

If things are bad now, imagine how bad they will be in the future. Let’s extrapolate these to 2051. Why 2051? Well, Toronto has recently undertaken official plan updates that required them to ‘plan’ for 2051, so it seems a logical endpoint for this analysis.

If we assume that the next 26 years will see an annualized inflation in DCs at the rate we saw over the last 10 years, then by 2033, DCs for 2-bedroom units in Toronto will be above $250,000, and by 2037, they’ll be at $500,000, by 2042 they’ll be above one-million, by 2046 they’ll cross the two-million mark, and finally by 2051, they’ll be above four-million. Because of the nature of exponential growth, such increases make the skyrocketing growth of the last decade look relatively flat.

Source: MMI Calculation.

Graphing this on a logarithmic scale gives a better sense of how the City of Toronto's development charges have increased in recent years and what will happen if these trends continue.

It’s important to understand that development charges grow exponentially, causing a ‘compound interest’ effect. If Toronto doesn’t substantially and immediately bend the curve on how fast DCs grow, Toronto’s affordability crisis will continue to get worse.

We should also recognize that while a million-dollar per home development charge seems impossible today, development charges have risen almost 6,000% over the last 25 years. For example, an $81,000 development charge on a two-bedroom apartment in Toronto would have seemed out of the realm of possibility 25 years ago when those charges were well under $2,000.

It is not just our hypothetical family that has been priced out. Most young Canadians in their 20s and 30s in major cities like Toronto find it challenging, if not impossible, to buy a two-bedroom home. It's not shocking that many of them feel despondent about their prospects and the direction of this country.

This is a crisis and must be treated as one.