Introducing the British Columbia Housing Construction Tax Calculator

A tool to model the impact of tax and fee policy changes on the price of home construction in BC.

View the calculator here: British Columbia Housing Construction Tax Calculator

Designing your housing construction tax cut

In "How Taxes and Taxes-on-Taxes Add Over $250K to a Vancouver Condo," we saw how the federal GST, the provincial property transfer tax (PTT), and municipal development cost charges and related fees cause the price of a home to be over $250,000 higher than it would be otherwise.

Naturally, this led to numerous questions about how these costs could be reduced. To help address these questions, we have developed a free-to-use British Columbia Housing Construction Tax Calculator, which allows others to design their own tax reforms and scenario analyses, including development charge reforms and enhanced GST and PTT rebates.

The calculator is available on Google Sheets.

Instructions

At the top of the sheet, there are sections labelled “Costs” and “Tax Rebates”.

Fields in peach are editable and allow the user to enter information about the cost of a project, as well as design their own tax reform policies.

The cost-related fields are as follows:

Hard + Soft Costs + Profit Excluding Fees and Int. on Fees: This is all the costs and profits, excluding development charges, the GST and property transfer tax (PTT). In the example from our report, the final project would have a price of just under $1.1M in the absence of these taxes and fees.

Development Charge 1/2/3/4: This allows the user to enter the dollar cost of up to 4 development cost charges (DCCs) and related fees. In our Vancouver example, we had Development Cost Levies (DCLs) + Utility DCLs, Community Amenity Contributions, Metro Vancouver Development Cost Charge (DCC), and TransLink Development Cost Charge (DCC) as our four DCC-related fees, totalling $130,531.

Discount: The user can discount DCCs and related fees at any rate they wish. For example, the federal government has proposed a program that would help municipalities reduce DCCs on multi-unit residential buildings by 50%. In our example above, we have discounted fees by 20%. Each DCC can be discounted at a different rate, if desired.

Construction Loan Int Rate: The interest rate on a construction loan. This is relevant because DCCs must be paid for at the beginning of construction, but the developer does not receive full payment until the project is completed, so those DCCs must be debt-financed for some time. In our example above, we have set the rate at 4.70%.

Fee Deferral Int. Rate: Some jurisdictions allow development charges to be deferred until completion, rather than at the beginning of construction. Some municipalities that offer this option charge interest on that deferral; others do not. In our example, we have set this rate to 0.00% to model the impact of an interest-free deferral; however, the user has the option to set this rate to any value they prefer.

Number of Months of Interest on Fees: This is the length of time between the start of construction and the completion of the project; in other words, the length of time that DCCs need to be financed, with interest. In our example, the developer must carry these costs for 28 months, but the user can enter any value (in months) they wish. Do not set this to zero to model the impact of a DCC deferral, as the simulator will automatically calculate this as one of the scenarios.

The user also has the option to model the impact of two separate tax rebates:

PTT Rebate (in Blue). Currently, the purchaser of a new home receives a 100% rebate for any new home valued under $1.1 million (lower bound), with the rebate phased out between $1.1 and $1.15 million (upper bound). In the cells in peach, the user can alter these parameters. In our example, we have increased the upper bound to $1.5 million, but left the lower bound ($1.1 million) and the rebate rate (100%) unchanged.

GST Rebate (in Yellow): Similar to the provincial PTT, there is a GST rebate on new homes, though the rebate is far less generous. The full value only applies to homes valued under $350,000 (lower bound) and is phased out between $350,000 and $450,000 (upper bound), and the maximum rebate value is only 36% of GST paid. In our example, we have adjusted these values to $1,000,000, $1,500,000, and 100%, respectively, to align with the federal government’s proposed First-Time Home Buyers’ GST Rebate. However, the user can enter any parameters they wish.

Results

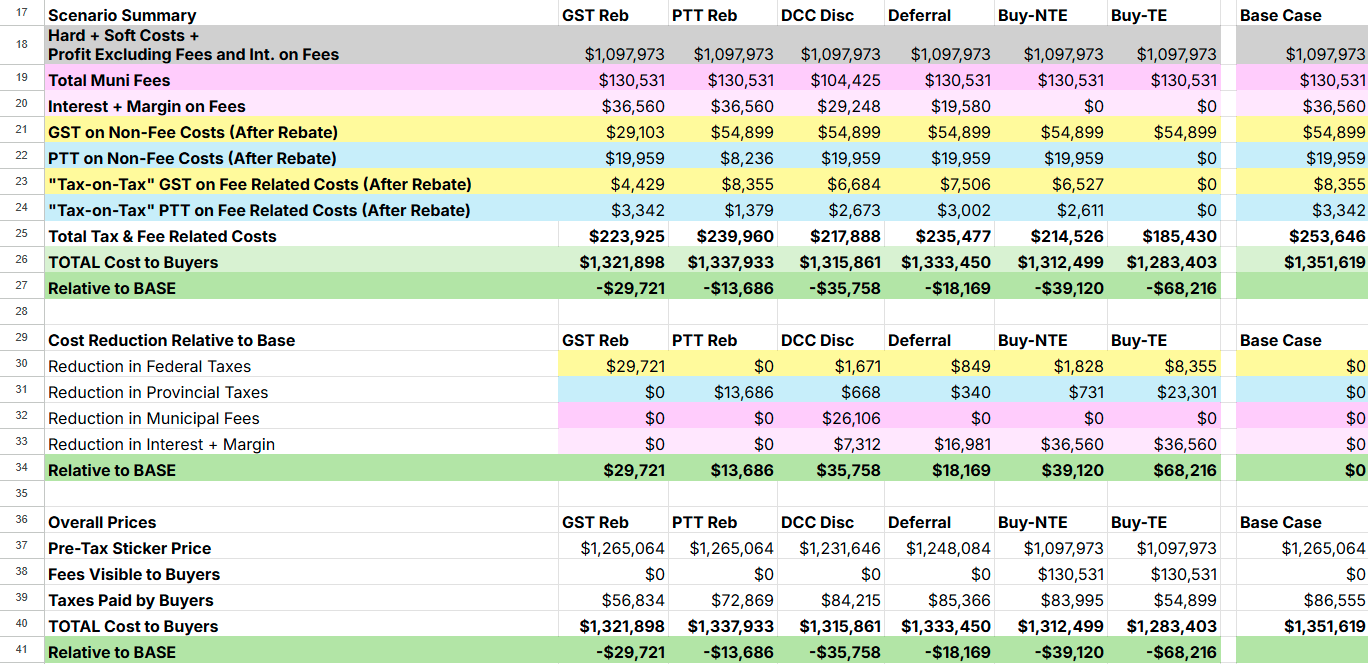

Based on the inputs entered by the user, the simulator provides costs for six different scenarios as well as the base case.

The seven scenarios are as follows:

BASE: The base case, where no policy changes have occurred. In this case, the price of the home is just over $1.35 million.

GST Reb: In this scenario, the federal government introduces a revised GST rebate, and no other policy changes occur. In our example, this results in a $29,721 reduction in federal taxes.

PTT Reb: A similar scenario, except now the provincial PTT rebate is lowered, resulting in a $13,686 reduction in provincial taxes.

DCC Disc: This assesses the cost reduction from discounting DCCs and other related fees. In our example, this results in a reduction of $35,758 in overall costs. Note that municipal fees themselves are only reduced by $26,106; the rest of the savings come from lower GST and PTT payable, as well as a $7,312 reduction in “junk fees” - interest rate expenses and margin requirements stemming from the requirement to carry DCCs as a cost.

Deferral: This scenario occurs when DCCs are deferred until closing. This reduces junk fees by $16,981 through lower interest costs.

Buy-NTE: In this scenario, DCCs are charged to the buyer as a separate line item when purchasing a home. In this scenario, the developer no longer operates as a flow-through entity, cutting out the middleman. In the NTE (“not tax exempt”) scenario, the buyer still must pay GST and PTT on development charges. The overall savings are $39,120, almost entirely due to a reduction in junk fees that stem from requiring the developer to act as the middleman.

Buy-TE: Similar to above, but now DCCs are exempt from being charged GST and PTT. This avoids the tax-on-tax nature of DCCs and can also create substantial savings, as it can lower the sticker price of the home to make it eligible for PTT and/or GST rebates. In this scenario, the price of the home is reduced by $68,216.

Questions? Thoughts?

Please send us a note if you have any questions or thoughts about this calculator. If MMI readers find this useful, we will create similar calculators for other provinces.