Is Doug Ford About to Slash $100K Off the Price of a New Home?

The Premier of Ontario makes the federal government a bold offer

Highlights

Premier Doug Ford indicated that the province of Ontario would be willing to match a proposed federal enhanced new housing rebate.

A combined enhanced federal + Ontario rebate would cut the cost of new home construction by up to $106,000.

Doug Ford makes an offer; can the federal government refuse?

Yesterday, Doug Ford may have set in motion reforms that will lead to new home prices falling by $100,000. Here’s how.

A group of housing-related organizations, including MMI, have called on the federal government to enhance the current GST Housing Rebate, to cut homebuilding costs by up to $50,000 and address Canada’s cost-of-delivery crisis in homebuilding.

This led reporter Barbara Patrocinio of QP Briefing to ask Doug Ford if he would consider such a move. Surprisingly, instead of giving the standing political “answer that isn’t really an answer”, he responded by making the federal government a bold offer:

"If the federal government came and waived the [HST], the federal side, then we'd look at the provincial side as well... But I'll tell you one thing, I don't want to go in the pockets of builders or developers... We'd have to rebate the people directly. So we actually see the prices come down”

We ran the numbers, and if this were to come to fruition, home prices would fall by over $100,000 from the status quo. To understand why, let’s start with the status quo.

Our current new housing rebates are out of date

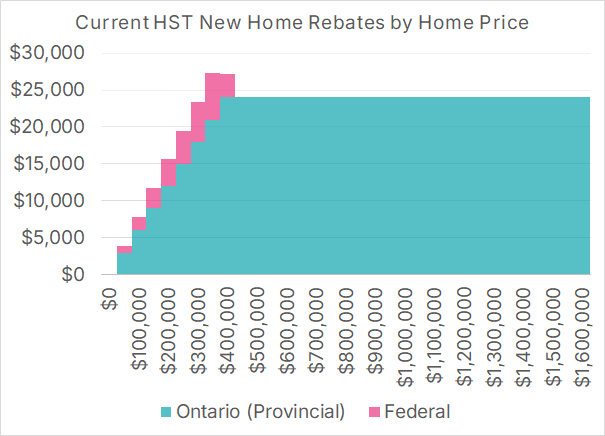

Currently, homebuyers in Ontario are eligible for two HST rebates on new housing:

A federal rebate worth 36% of the federal portion of the HST paid on a home valued up to $350,000, creating a maximum rebate value of $6,300. This rebate is reduced for homes valued between $350,000 and $450,000. Homes valued over $450,000 receive no rebate.

A provincial rebate worth 75% of the provincial portion of the HST paid on a home valued up to $400,000, creating a maximum rebate of $24,000. Unlike the federal rebate, the provincial rebate is not phased out; instead, buyers of homes valued above $400,000 also receive $24,000.

The combined maximum rebate value is just over $27,000 for homes in the $350,000-$400,000 range, as shown in Figure 1.

Figure 1: Current HST New Home Rebates by Home Price

Source: Author’s Calculation

Three things to note about these rebates:

Their thresholds ($350,000, $400,000, $450,000) are so low because they are not indexed for inflation and have never been adjusted. The federal rebate has been unchanged since the GST went into effect on January 1, 1991, and the provincial rebate has been unchanged since the province adopted the HST on July 1, 2010.

Not all purchases of new homes are eligible for the rebate. The rebate can only go to an individual (not a corporation or partnership), and the home must be used “as the individual's, or their relation's, primary place of residence”, though there are other rebates with different criteria, such as the New Residential Rental Property HST Rebate.

The rebate only applies to the sale of new homes, as the sale of existing homes is HST-exempt to begin with.

Now let’s compare this to enhanced provincial and federal rebates.

Revised new housing rebates can save purchasers over $100,000

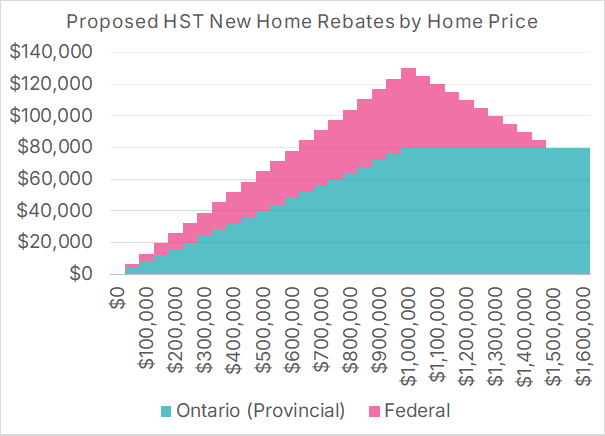

The federal government has introduced a First-Time Home Buyers’ GST Rebate, which would raise the lower threshold of the existing rebate from $350,000 to $1,000,000, raise the upper threshold from $450,000 to $1,500,000, and increase the maximum rebate from 36% to 100%. The housing consortium has proposed removing the first-time homebuyer restriction and instead keeping the eligibility requirement from the current rebate.

Doug Ford indicated that the province would match this initiative if the federal government adopted it. The fact that the current Ontario rebate does not have a phase-out makes a direct match tricky. Instead, the province could consider matching the rebate increase (from 75% to 100%), lowering the threshold (from $400,000 to $1,000,000), and retaining the existing lack of phase-out.

If this were adopted, a home valued at $1,000,000 would now be eligible for a rebate of $130,000. This is over $100,000 more than the maximum rebate under the current system!

Figure 2: Proposed HST New Home Rebates by Home Price

Source: Author’s Calculation

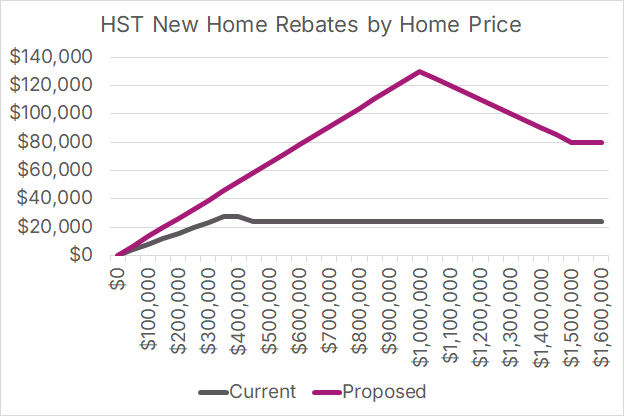

The increase in the size of the rebate is substantial, as shown by a graph comparing the existing and proposed combined federal + Ontario new housing rebates.

Figure 3: Proposed HST New Home Rebates by Home Price

Source: Author’s Calculation

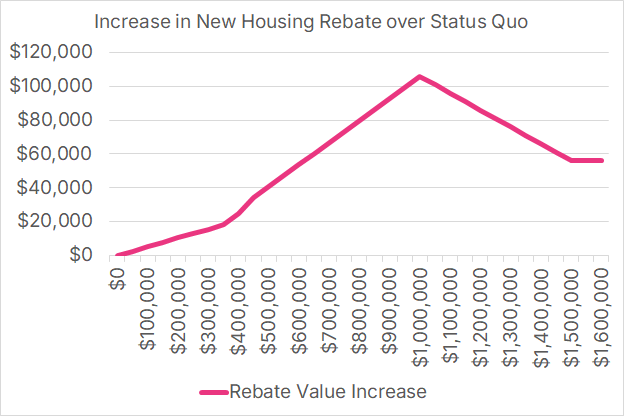

Relative to the status quo, the biggest rebate increase occurs for homes worth $1,000,000, where the revised Ontario + federal rebate would be $106,000 higher than the existing one.

Figure 4: Increase in Rebate Size from a Revised Fed+Ontario New Housing Rebate

Cutting the cost of new home construction by $100,000 would be a game-changer

Because the GST only applies to new housing, it acts as a development tax (or, if you prefer, a development charge), increasing the cost of homebuilding and causing fewer homes to be built. Doug Ford has offered the federal government a deal that would cut the cost of homebuilding by, in some cases, over $100,000. This would be a game-changer in addressing the housing construction industry’s cost-of-delivery crisis, and get a whole lot of shovels in the ground.

Let’s hope the federal government accepts the Premier’s offer.