Ontario’s Housing Sales Collapse: It’s Not Just Toronto Condos

Understanding what’s really happening in Ontario’s housing market.

In this episode of The Missing Middle, hosts Sabrina Maddeaux and Michael Moffatt discuss the ongoing housing crisis in Southern Ontario, focusing on the significant drop in new home sales and the implications of a recent report by the Missing Middle Initiative’s Jesse Helmer.

They explore the challenges of affordability, the impact of interest rates, and the political landscape surrounding housing development. The conversation highlights the disconnect between government targets and actual housing starts, emphasizing the urgent need for action to address the crisis.

If you enjoy the show and would like to support our work, please consider subscribing to our YouTube channel. The pod is also available on various audio-only platforms, including:

Below is an AI-generated transcript of the Missing Middle podcast, which has been lightly edited.

Mike Moffatt: So, Sabrina, I'm in Ottawa, and I'm not going to be buying a home anytime soon. The next home I buy might potentially be for my kids a long time from now. You're in the GTA, where we've seen prices go down by about 20% or more since early 2022. Does it really feel any easier today to buy a home than it did back then?

Sabrina Maddeaux: No, absolutely not. The affordability crisis is still very real. Prices surged by so much over the last decade and more that prices are still very disconnected from incomes, and saving a down payment is still practically impossible without family help or an inheritance.

At the same time, you have rent prices remaining very high, even though they're coming down a little bit, which complicates saving even further. So I don't think I'll be buying a home anytime soon either. Now, it seems I'm not the only one, though, who thinks it's tougher to buy a new home these days despite some price decreases.

Earlier this week, the Missing Middle Initiative released a report in partnership with the Residential Construction Council of Ontario, which examines new housing starts and sales in 34 municipalities across Ontario. Now, I've read the report and the word that comes to mind is “bleak”. Mike, can you give us an overview?

Mike Moffatt: Yeah, absolutely.

We have seen starts and sales go down. So, the market itself is telling us, “Hey, there's a problem here.” There are four big takeaways from the report, which was authored by our MMI colleague, Jesse Helmer; we'll link to the report in the show notes. Four big takeaways here:

The first is that Ontario's housing slowdown is not isolated to the city of Toronto. We often hear that “Oh, well, this is kind of a downtown Toronto problem,” but we're seeing it all across the GTA and the Greater Golden Horseshoe. This includes Brantford, Kitchener-Waterloo, St. Catharines, Peterborough, Barrie, and more. This isn't just a downtown Toronto problem.

The second thing is that the slowdown isn't isolated to high-rise condos. We're seeing massive drops in activity in ground-oriented housing. So that's your single-detached, your semi-detached, your townhomes, and so on.

The third point is, as bad as housing starts are, and they are really bad right now, pre-construction sales are even worse. So that means that things are going to get worse on the start side before they get better. And number four, that we talk about housing and housing starts in context to things like housing targets, and those are really important. But there are broader economic consequences here.

We estimate that 21,000 person-years of employment will be lost due to falling housing starts in just the first six months of 2025 alone. So, we're talking about 20,000, or more, jobs. This has big ramifications.

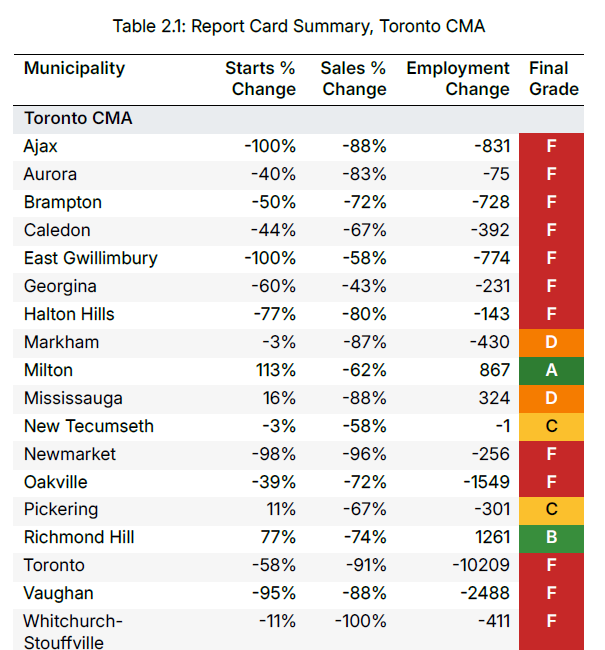

Then what Jesse did was he assigned grades to each municipality based on five categories. We came up with a very objective scoring system. Once we ran the numbers, 22 out of 34 municipalities got an F for their housing performance, and that's probably only going to get worse.

Sabrina Maddeaux: On your first and second points, we've done a few episodes about the implosion of the condo market, and we can link to those in the show notes. But what this report shows us is that the slumping market isn't just about condos. So what's going on with all the other types of homes?

Mike Moffatt: Yeah, absolutely.

So what we did specifically was look at the first quarter and second quarter of 2025. So the first six months of 2025, and compare that to an average of the first six months of the four previous years, going back from 2021 to 2024. And condo starts are down about 54%. Now that's offset a little bit by purpose-built rentals being up 8%.

The story we hear there is that with higher interest rates and so on, investors have left the market. Investors were driving a lot of this activity, and they've gone away. Now we don't have a market, particularly for those kinds of shoebox condos, as you and Ron Butler like to call them.

All of that is true, but there's more going on than that. Ground-oriented housing - your single detached and semi-detached, townhomes and things like that, those starts are down 42%. So not as much, but pretty close. People can't qualify for mortgages with interest rates being where they are- 200 points on the stress tests and so on. That, coupled with the fact that we have a pretty weak economy, people are worried about their jobs, they're worried about “if I make this big investment, am I going to be able to pay it off? Am I going to be employed two or three years from now?” So it's just to put a chill in this market.

So it was one of the points we really wanted to get across, and I think Jesse did a great job of showing that: this is not just a shoebox condo issue, we're seeing this across all housing types.

Sabrina Maddeaux: I'd like to drill down on another one of your points, that sales numbers seem to be worse than starts. First of all, can you remind us all what a start is? And what does it mean that sales are worse than starts?

Mike Moffatt: Yeah, everybody kind of gets confused about this, even policymakers themselves, on what a housing start is. I think you and I would think most people would think of it as just a shovel going into the ground, or maybe somebody getting a building permit or something like that. Well, the CMHC counts a housing start as once the foundation is all done and built to what they call grade or basically ground level.

Imagine you have an apartment building with an underground parking garage; it could take like two years for that foundation to be completed. So you have two years of work before the CMHC says that work has started. It's a little bit of a weird metric, and what it shows is that it's what economists call a lagging indicator: it shows the health of the market a few years ago.

Whereas pre-construction sales involve people actually putting down a deposit or a down payment and saying, ”Okay, yeah, I want to buy that condo or I want that single detached home,” or so on. They give you a much better real-time indicator of where things are going. We see that condo pre-construction sales are down 89% - they’ve fallen to basically 10% of what they were.

Again, a lot of that is investor activity, but even if we look at ground-oriented homes, which largely aren't investor activity, that's usually families putting down a down payment; those are down 70%, which is a massive reduction. This year's pre-construction sales are 2026’s or 2027’s housing starts. If you don't have sales, you're not going to have starts in the future. And this is why we see things getting worse before they get better.

Sabrina Maddeaux: Now in 2022, the Ford government set a target to build 1.5 million homes over the coming decade. Is there any conceivable path to actually get there by 2032?

Mike Moffatt: Well, this was always a massive stretch goal, but theoretically, back in 2022, if we had all three orders of government working together, making the necessary changes, we might have been able to get there. It would have been tough, and even a year ago, it was probably impossible or close to it.

Right now? No, it's not going to happen.

According to the government's own schedule, the provincial government's own schedule, we need to be hitting like 150-175,000 a year. We're going to be lucky this year on starts if we get to 75,000, like half of what we need. We're likely to come in even lower than that. This is a challenge we have both provincially and federally, where we have these promises to double housing starts, and we're not even treading water, like things are going down.

The CMHC says that across Canada, they're projecting housing starts to fall by three to 4% a year, every year through 2027. It's not even a matter of us trying to double housing starts to keep that promise. We can't even keep them level, and that's a problem.

Sabrina Maddeaux: I have to ask, do you have any good news for us?

Mike Moffatt: No. Simple answer, unfortunately not.

If I'm trying to be an optimist here, I would say that the first step to solving any problem is admitting that you have one. We're hopeful that this report will really wake people up. But, no, there's not a lot of good in this.

There are a couple of apartment starts in Brantford, and there are a couple of municipalities with decent grades, but for the most part, you nailed the description. This is a very bleak report.

Sabrina Maddeaux: Now, speaking of admitting you have a problem, despite the fact that we're nowhere near those 1.5 million promised homes, Ford's government got reelected this past spring with a resounding majority. But there still seems to be this real lack of political pressure to actually make these bills happen. Why do you think that is?

Mike Moffatt: Yeah, I think there's a few things going on. First, I think every order of government is waiting for the other to act. We saw this, we saw the Ford government say “hey, we will cut HST on new homes if the federal government does so.” So there's this game of chicken going on, and cutting the HST either temporarily or permanently on new homes absolutely would help get shovels in the ground, so I think that's part of it.

Part of it is that policymakers still see this as a shoebox-condo problem and say, “Well, we don't really want shoebox condos, and we're not gonna lose too much sleep if we stop building those, even though it costs 21,000 jobs.” They say, “Well, this is going to be a market correction.” And if that was the only thing going on, I can say I don't necessarily agree with that, but I get the logic. I think part of it is that they're just a little bit in denial about how widespread the problem is.

And then finally, I think it's just money. Whether it be GST or some of these other things, they're not free.

I would say, if you're not selling any homes, you're not collecting any GST. At the end of the day, 0% of something is the same as 8% of nothing: It's nothing.

You'd be better off stimulating those sales, and then getting it back in income taxes and stuff like that. So that's my take. I would love to hear your take.

You're a little bit more politically attuned than I am, so why do you think we're just not seeing that movement?

Sabrina Maddeaux: All the reasons you listed.

I do think the point about tax revenue is a good one. I think psychologically, they're worried that it will lead to less, even though, like you said, if you're getting zero sales, then you're getting zero taxes, so they should do the math on that.

But as we know, politicians just aren't accountable to people who don't already live in their communities. So future homeowners, people who want to buy, haven't been able to organize in a way that has been effective enough to really capture politicians’ attention, so they find it easy to ignore these constituents who are often younger as well.

I do think that the issue is getting more media attention, more headlines, and now that it's rolling into bigger unemployment numbers. And developers are running into more financial trouble - I think that pressure will build even if it doesn't end up coming from younger people and potential homeowners themselves.

Hopefully, we will see more attention on this soon.

Thank you, everyone, for watching and listening, and to our amazing producer Meredith Martin.

Mike Moffatt: If you have any thoughts or questions about what it means for a foundation to be at grade, please send us an email to the [email protected], and we'll see you next time.

Failing Grades, Falling Starts: Ontario Housing’s Bleak Mid-Year Checkup

Earlier this summer, RESCON approached the Missing Middle Initiative to conduct an analysis of the state of new housing in Ontario. This led us to release the first of a series of quarterly report cards. The full report, Q2 2025 GTA and GGH Housing Report Card: Starts, Sales, and Employment

This podcast is funded by the Neptis Foundation

Brought to you by the Missing Middle Initiative