The Big Collapse: New Condo Sales Down 89%, Ground-Oriented Down 65%

The Q3 report from MMI and RESCON

Highlights

Ontario’s housing engine has stalled: Starts are collapsing across the GTHA and GGH. Condo starts are down 51%, ground-oriented homes are down 43%, and overall starts are down 34%, with only rental apartments keeping the sector on life support. The weakness is not confined to condos or to Toronto.

Tens of thousands of jobs are vanishing: The construction slowdown now equals 35,377 lost person-years of employment in the first 9 months of the year, and the losses are accelerating quarter after quarter.

The real crash is still ahead: Pre-construction sales have fallen off a cliff, condo pre-sales down 89%, ground-oriented pre-sales down 65%, guaranteeing an even deeper downturn in 2026 and beyond.

The full report card can be downloaded at the bottom of this piece.

The Q3 2025 GTA and GGH Housing Report Card

Earlier this summer, RESCON approached the University of Ottawa’s Missing Middle Initiative to conduct an analysis of the state of new housing in Ontario. Our initial assessment, based on first- and second-quarter data from the Canada Mortgage and Housing Corporation (CMHC) and the Altus Group, was bleak.

The story is not getting any better, except for purpose-built rental apartments.

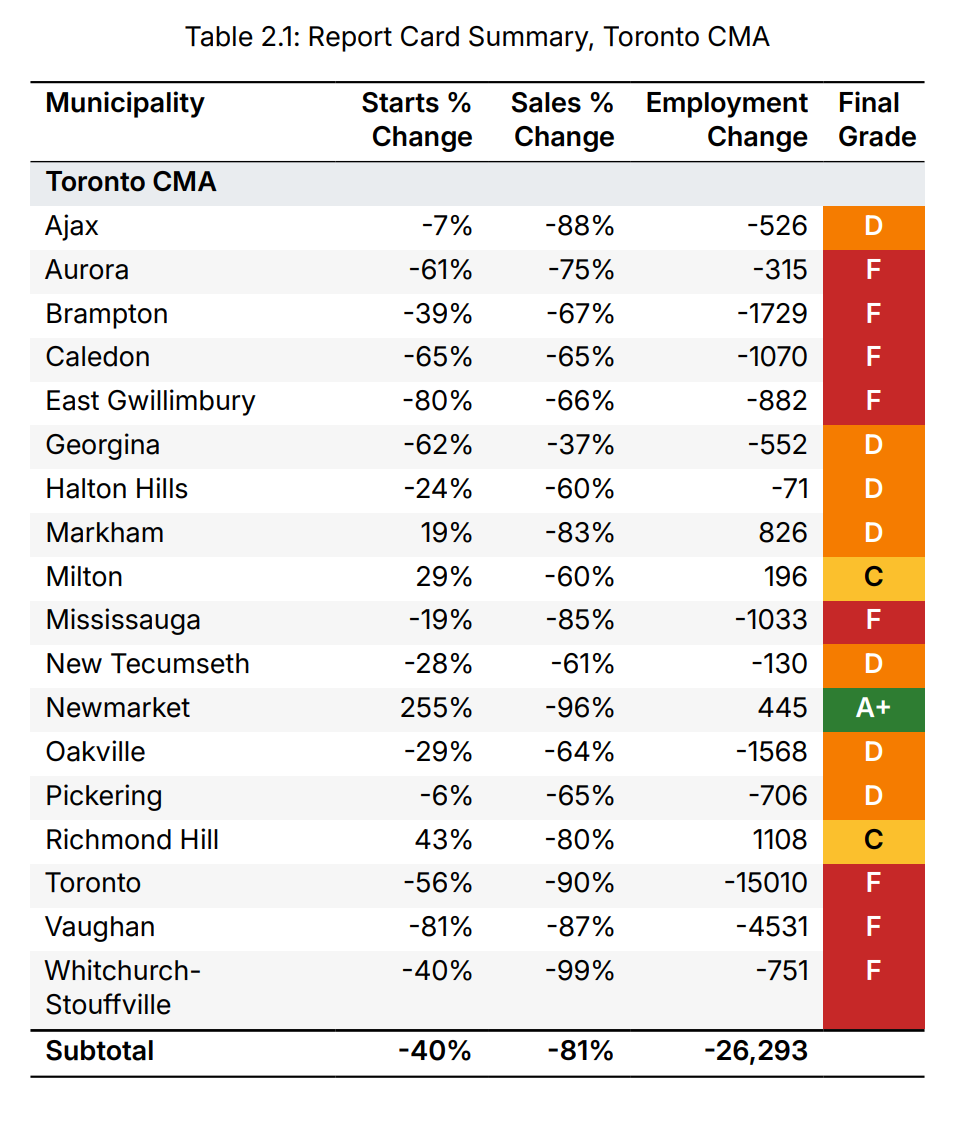

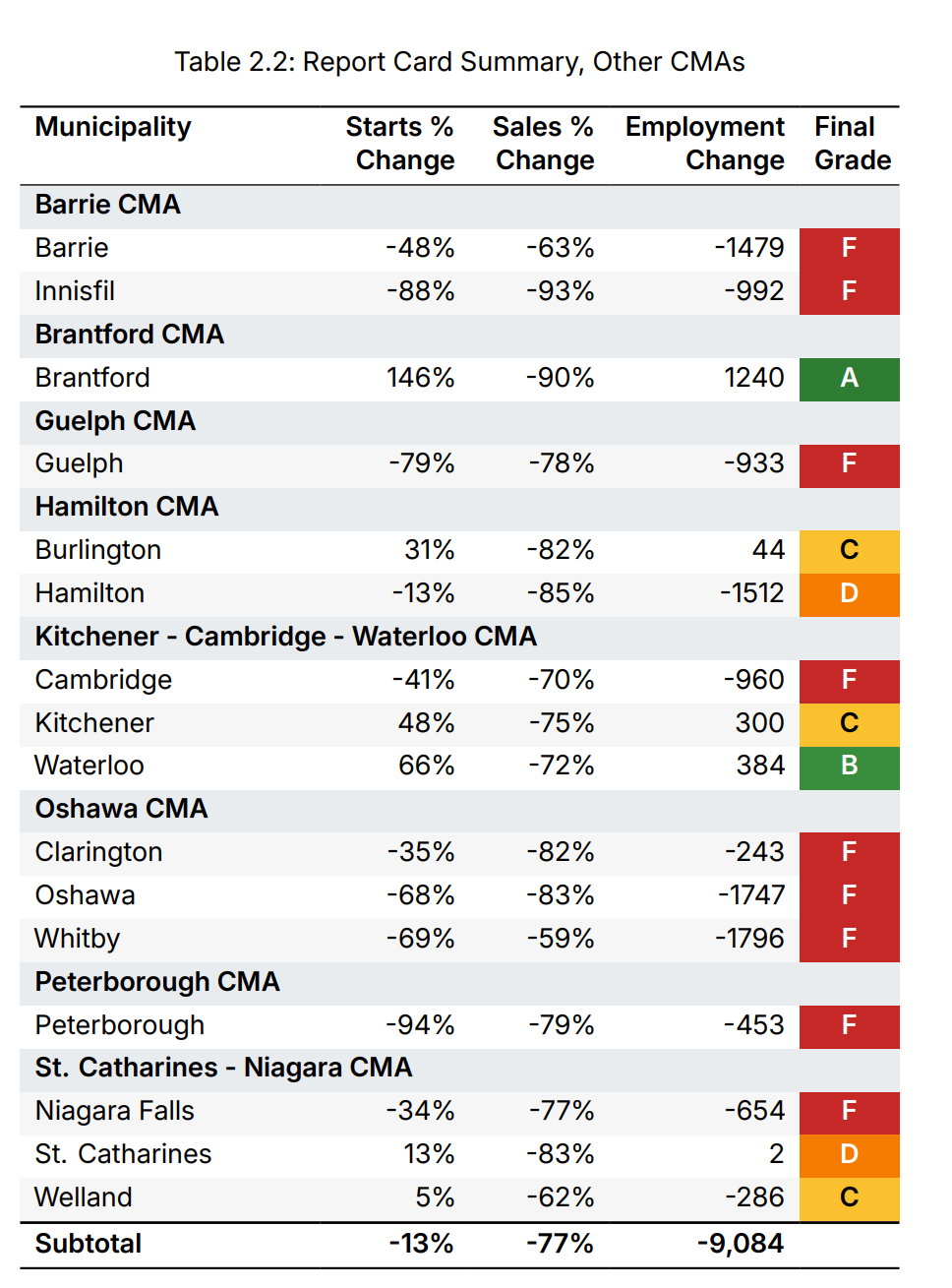

We examine 34 municipalities across nine metro areas in the Greater Toronto Area and the Greater Golden Horseshoe region and assess the state of housing sales and construction over the first nine months of the year, relative to the first nine months of the previous four years (2021-25).

In the first nine months of the year, housing starts are down 34% in those 34 municipalities. Condo apartment starts over the past nine months are down 51% relative to 2021-24 January-September averages. On the positive side, purpose-built rental starts are up 42%. Ground-oriented housing (everything other than apartments) starts are down 43% in almost every municipality — Brantford, Markham and Richmond Hill are notable exceptions — showing that the region’s housing weakness extends well beyond the condo market.

In our Q2 2025 report, the decline in housing starts observed in the first six months translated to 24,195 fewer person-years of employment. This negative trend in employment has continued: the reduction in housing starts over the first nine months of the year relative to 2021-24 averages translates into 35,377 fewer person-years of employment (+11,182 vs. the Q2 2025 estimate of 24,195). On average, it takes 3.8 years of employment to build a ground-oriented home, and 1.5 years to build an apartment unit, so the growth in rental apartment starts has only partially offset the employment losses associated with declining ground-oriented and condo apartment housing starts.

Unfortunately, given the state of new home sales, things are going to get worse before they get better. Housing starts are a lagging indicator, as the CMHC only considers a unit “started” when a building’s foundation is 100% complete, so they often reflect market decisions several years prior, when the decision to build was made. Pre-construction housing sales are a better indicator of the market’s current health and are indicative of future housing starts.

Over the first nine months of 2025, relative to 2021-24 averages, pre-construction condo apartment sales are down 89%, and pre-construction ground-oriented sales are down 65%. This is a clear indication that Ontario’s housing situation will get worse before it gets better. Market weakness continues to not be isolated to the condo market.

Each of our 34 municipalities was assessed across five categories, three reflecting starts (ground-oriented, condo apartments, rental apartments) and two reflecting sales (ground-oriented, condo apartments), and given a grade; see the methodology section for details. 7 For our 34 municipalities, 17 (-5 vs. Q2 2025) received an F, and another 9 (+4 vs. Q2 2025) received a D. While the other eight municipalities received a C or higher (+1 vs. Q2 2025). Average grades have improved slightly since Q2 2025, but because starts are a lagging indicator, we continue to expect average grades to fall in future reports.

To download the full report, click on the link below: