Don’t Expect a Housing Miracle in Today’s Federal Budget

The Carney government’s first budget is likely to tinker, not transform.

Highlights

Few major housing measures are expected: Despite hopes, today’s budget will likely feature only minor housing announcements, with most campaign promises already underway or pending.

GST rebate already legislated: The first-time homebuyer HST rebate in Bill C-4 covers homes under $1.5 million, but expansion to all buyers is unlikely.

Development charge cuts face hurdles: Cutting DCs in half, without major design changes, would exceed budgeted costs and disproportionately benefit Ontario and B.C., delaying implementation.

The MURB incentive is still in design: The revival of the 1970s Multiple Unit Residential Building tax measure requires consultations and additional time for design before it can be implemented.

Possible incremental steps: The budget may boost CMHC’s Apartment Construction Loan Program or modestly advance smaller platform items, such as housing conversions and flood insurance.

Keep your expectations low, and you will never be disappointed

The Carney government releases its first federal budget today, and hopes are high that the government will announce significant measures to move us closer to its 500,000 annual new home target and to stem the massive decline in new home sales, of all types, in Canada’s major markets.

Despite this hope, it appears highly unlikely that there will be any large new housing announcements today. An examination of the Liberal housing platform reveals a list of items that are already underway or that require additional work to be implemented. While the federal government may surprise Canadians by announcing, for example, a revised GST new housing rebate, all indications are that it will stay the course, and any new announcements will be relatively minor.

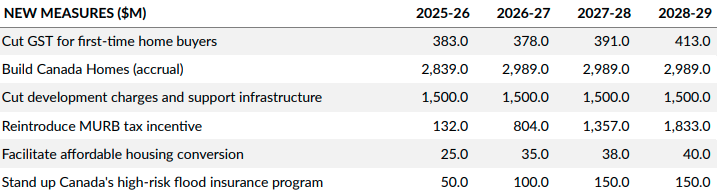

During the federal election campaign, the Liberals made six campaign promises related to housing, with 90% of their planned spending going to three initiatives: Build Canada Homes, cutting development charges, and reintroducing the 1970s-era MURB provision, as shown in Figure 1.

Figure 1: Annual cost of federal Liberal campaign promises on housing

Source: Liberal platform campaign costing

Reviewing the list, one item at a time, reveals why it is unlikely that we will see many new announcements in today’s budget.

GST cut for first-time homebuyers: This measure was included in Bill C-4, known as the Making Life More Affordable for Canadians Act. The Bill was introduced into the House in July and has still not passed, but when it does, first-time homebuyers who purchased a home on or after May 27, 2025, will receive some or all of the federal HST they paid on that home rebated, so long as the home price was under $1.5 million. The province of Ontario recently announced that it would match the rebate on the provincial portion of the rebate. Several groups have called on the federal government to expand the rebate to all primary-residence purchasers of new homes, with Premier Ford indicating that the province of Ontario would also match such a move. However, it appears highly unlikely that the federal government will introduce such a provision in today’s budget.

Build Canada Homes: This program was launched on September 14, 2025; we are unlikely to see any major revisions or additional details on the initiative in the budget.

Cut development charges and support infrastructure: This is likely to be the biggest housing-related item in the budget, but much work needs to be done to implement such a promise, so do not expect development charges to be reduced by the end of the year. It requires negotiation with provinces and municipalities, and there are at least two major challenges the federal government must overcome. The first is that, without design changes, the program would cost more than the $1.5 billion per year indicated in the Liberal platform. The second is that, if the promise to cut development charges in half is taken literally, almost all of the money would go to Ontario and British Columbia, and little would go to Quebec and Alberta, creating a political headache for the federal government.

Reintroduce MURB tax incentive: As we stated in an earlier piece, the reintroduction of the MURB (Multiple Unit Residential Building) tax provision, an obscure 1970s tax provision that incentivizes the construction of small-scale rental housing, could have a radical impact on housing construction in Canada. There will likely be some reference to the promise in the budget; however, significant consultation and design work needs to happen before it is implemented, so our expectations are low that a full program will be announced.

Facilitate affordable housing conversion and stand up Canada’s high-risk flood insurance programs: These have relatively modest dollar figures attached to them, and additional details on one or both are likely to be in the budget.

Overall, our expectations are low that today’s budget will significantly advance, or expand upon, the housing promises made in the Liberal platform. That only leaves non-platform items. There is a high probability that the federal government will make additional capital available in the CMHC’s highly successful ACLP (Apartment Construction Loan Program) lending vehicle. It is also possible that the federal government reduces immigration targets even further; while not a housing program, it would reduce the demand for homes.

Overall, our expectations are quite low going into today’s budget. However, we hope to be pleasantly surprised, and the federal government shows more ambition and urgency than they have to date.