The PBOs Math Is Clear: We Need an Expanded GST Housing Rebate

The proposed federal First-Time Home Buyers’ GST Rebate would only apply to 5% of homes; not enough to get shovels into the ground.

Highlights

A newly released Parliamentary Budget Office study finds the federal government’s proposed GST rebate for first-time home buyers will only apply to 5% of housing starts, roughly 13,000 per year.

The goal of housing-related GST reform should be to address the cost-of-delivery crisis that is preventing more homes from being built. The current reform is too small to get shovels into the ground.

The PBO estimates that if this rebate were expanded to all owner-occupiers who purchase new homes, it would cover 60,000-65,000 homes per year. If it applied to all buyers of non-purpose-built rentals, it would cover 130,000-135,000 homes.

With the information provided in the PBO study, we estimate that the annual fiscal cost of extending the rebate to all owner-occupiers would be $2 billion, in line with the PBO’s estimate of the Conservative GST housing election promise. If it were extended to all buyers, the fiscal cost would be roughly $4 billion annually.

These estimates do not account for the increased homebuilding that would result from lowering the cost of housing construction. More homes would be built, and all three orders of governments would receive additional taxes from increased economic activity. For the federal government, this would partially offset the revenue loss from an enhanced GST New Housing Rebate.

The federal government should strongly consider extending the rebate to all owner-occupiers of new homes, to help accelerate housing construction and address the cost-of-delivery crisis.

The case for a $2 billion rebate that builds homes

We have written a series of pieces on the federal government’s proposed First-Time Home Buyers’ GST Rebate, which we have characterized as “a move in the right direction, but it does not go nearly far enough to meet the federal government’s housing ambitions.” Specifically, we noted:

Because the GST only applies to new housing, it acts as a development tax (or, if you prefer, a development charge), increasing the cost of homebuilding and causing fewer homes to be built…

The Liberals have limited their plan to first-time homebuyers. In our view, this is a mistake. The goal should be to increase the supply of housing, and such a restriction limits the effectiveness of the program. For example, the existence of the GST on housing discourages seniors from downsizing from their larger suburban homes to smaller, newly constructed senior-friendly housing. By eliminating the GST on housing, we can get more of these senior-friendly homes built and free up larger suburban homes for the next generation of families.

A report issued this week by the federal Parliamentary Budget Office (PBO) supports our conclusion. They find that a mere 5% of all housing completions, roughly 13,000 per year, would be eligible for the rebate. While any rebate will have a positive impact on the number of homes built, this is too small of a cohort to make a meaningful impact on the federal government’s goal of doubling housing starts.

The PBO does not provide estimates on the fiscal cost or the number of homes that would be eligible if this rebate were extended to all owner-occupier purchasers of new homes. However, using the data provided in the study, we can generate these estimates. We find that extending this rebate to all owner-occupiers would cover 60,000-65,000 new homes a year, at an annual fiscal cost of $2 billion. These estimates do not account for the increased homebuilding that would result from lowering the cost of housing construction, nor do they estimate the boost in revenue governments would receive from increased economic activity.

Given the federal government’s ambition to double housing starts and to have the “most ambitious housing plan since the Second World War”, as well as the Ontario government’s offer to match the rebate, we continue to support such an extension. A combined federal and provincial rebate would reduce new home costs by as much as $106,000.

If the federal government wanted to be particularly bold, it could drop the owner-occupier requirement in the existing rebate and open up the rebate to all purchasers of new homes. We estimate, using the PBO data, that this would increase the total cost to $4.2 billion and cover 130,000-135,000 homes annually. This would create an even faster acceleration of homebuilding than under the owner-occupier restriction. However, given the increased fiscal cost and the political challenges that would accompany such an extension, we recognize that the federal government would be quite reluctant to make such a move.

Here is how we, and the PBO, arrived at our numbers.

The math behind the estimates

Housing data in Canada is exceptionally limited, so the PBO was forced to make a number of back-of-the-envelope assumptions to arrive at its answers. Given these limitations, their method was quite impressive and took the following six steps:

First, they examined housing starts and other housing data to forecast housing completions for the years 2025 through 2030. Over time, completions rose from 236,000 to 261,000, still well below the federal government’s 500,000 annual starts target.

This completions forecast was then divided into purpose-built rental (which already has a full GST rebate) and non-purpose-built rental, with the latter accounting for approximately 135,000 to 145,000 completions per year.

Using data from Ontario’s existing HST New Housing Rebate, they estimate that roughly half of the 140,000 homes will be purchased by corporations, investors, or be used as secondary properties, leaving approximately 70,000 that will be purchased as owner-occupiers. The assumption that only half will be purchased by owner-occupiers seems low, but in the absence of more detailed information, the methodology used to derive this estimate is defensible.

Of those remaining 65,000-70,000 units, roughly 20% would be purchased by first-time homebuyers, bringing the total number of eligible units down to 13,000. The 20% estimate seems high, but in the absence of other data, the methodology employed by the PBO to generate this estimate is also defensible.

This estimate is then reduced slightly, as some of these homes will be sold for more than $1.5 million, and thus be ineligible for a rebate.

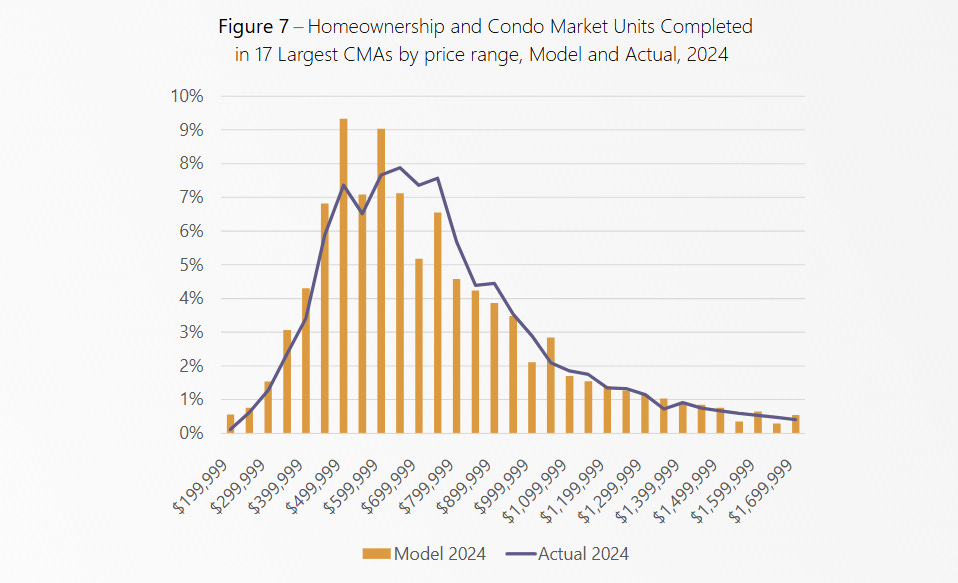

Using a distribution of home price data, the PBO estimates the First-Time Home Buyers’ GST Rebate will cost $1.9 billion over 5.5 years, or $300-400 million per year. The PBO wisely took into account the fact that first-time homebuyers disproportionately purchase lower-priced new homes when generating this estimate.

Unfortunately, the PBO did not estimate the cost of extending this rebate to all owner-occupier purchasers of new homes, or all purchasers of new homes. However, they did provide their estimate of the distribution of home prices, making it relatively straightforward to estimate the cost of each plan.

Figure 1: PBOs estimated new home price distribution for Canada

Source: Introducing GST rebates for first-time home buyers.

Suppose this rebate were extended to non-first-time buyers. In that case, the average rebate, based on the PBO distribution, is roughly $32,000, which is somewhat higher than the estimated $27,000 for the average first-time buyer rebate.

Using the forecasts of 135,000-145,000 new homes purchased annually, and 65,000-70,000 of those purchased by owner-occupiers, and eliminating any homes forecasted to sell for more than $1.5 million (which brings these estimates down to 130,000-135,000 and 60,000-65,000 respectively), it is a straight-forward calculation to show that, with an average rebate size of $32,000, the average annual fiscal cost would be $2 billion for an enhanced GST rebate that went to all owner-occupier purchasers of new homes, and $4.2 billion for all purchasers of new homes. These cost estimates would be reduced slightly after accounting for the cost of the existing GST rebate program.

We said it before, and we’ll say it again

With Premier Ford of Ontario indicating that Ontario would match a federal enhancement of the existing GST/HST New Housing Rebate, the case for a full rebate to all owner-occupiers of new homes is exceptionally strong. In Ontario, such a move would immediately drop the price of a $900,000 new home to $800,000, setting off a housing construction boom.

As we stated last week, a $100,000 savings on a new home would enable more families to qualify for mortgages, resulting in increased new home sales and the construction of additional homes. The impact would be instantaneous, as a revised rebate could take effect immediately, resulting in an immediate reduction in post-rebate prices.

Skeptics will naturally wonder, “Won’t homebuilders just raise prices by an offsetting amount, capturing the rebate for themselves?” That would be a legitimate concern in a hot market. However, in Ontario, home starts are cratering, with single-detached home starts at their lowest levels on record (dating back to 1955), and job losses are mounting. Revised rebates would address the cost-of-delivery crisis, allowing builders to offer homes at prices more families can afford, and help governments achieve their supply targets.

Revised rebates are win-win-win. Governments need to act.

Download a PDF of this article here: