This One Tax Fix Could Instantly Drop New Home Prices in Ontario by $100,000

Doing the math on enhanced HST rebates

Highlights

A proposed plan calls for governments to revise existing federal and provincial HST rebates, to provide a 100% rebate for new homes priced under $1,000,000, with a phase-out for homes valued above this amount.

In Ontario, this would immediately drop the price of a $900,000 new home to $800,000.

We have designed a calculator that incorporates land-value taxes to illustrate the impact of the move under various scenarios.

Premier Ford has expressed a willingness to adopt the measure so long as the federal government does as well.

Currently in Ontario, home starts are cratering, single-detached home starts are at their lowest levels on record (with records dating back to 1955), and job losses are mounting. Revised rebates would address the cost-of-delivery crisis, allowing builders to offer homes at prices more families can afford, and help governments achieve their supply targets.

How to shave $100,000 off the price of a home

Housing groups have proposed a plan that would offer a 100% rebate for both the federal and provincial HST paid on a new home, for homes priced under $1,000,000. Last week, Ontario Premier Doug Ford stated that “If the federal government came and waived the [HST], the federal side, then we'd look at the provincial side as well”, indicating that he is open to the idea.

Last week, we wrote about the idea and received several thoughtful questions regarding the plan's mechanics and its potential impact on home prices. Here is how it would work.

Rebates under the status quo

Currently, homebuyers in Ontario are eligible for two HST rebates on new housing:

A federal rebate worth 36% of the federal portion of the HST paid on a home valued up to $350,000, creating a maximum rebate value of $6,300. This rebate is reduced for homes valued between $350,000 and $450,000. Homes valued over $450,000 receive no rebate.

A provincial rebate worth 75% of the provincial portion of the HST paid on a home valued up to $400,000, creating a maximum rebate of $24,000. Unlike the federal rebate, the provincial rebate is not phased out; instead, buyers of homes valued above $400,000 also receive $24,000.

In Ontario, the common practice when buying a home from a builder is that they collect the rebate on your behalf and apply it to the sales price, so long as you are planning to use the home as a primary residence:

Keep in mind that the Builder's price in your Purchase Agreement is based on an assumption: the assumption is that you are USING the property being bought as a Primary Residence (meaning a residence for you and/or your immediate family) and, therefore, as a buyer, you qualify to receive the HST New Housing Rebate (to be assigned to the builder).

Because of this assumption, the Builder will require you to assign back to the Builder your entitlement to receive the HST New Housing Rebate from the government. That way, the Builder obtains the value of the HST rebates from the government and does not need to charge YOU to pay such an amount ON TOP OF your sale price. The assignment of this HST rebate typically occurs at Final Closing, and by assigning it, your purchase price from the builder will remain as stated in your Purchase Agreement.

So if you are buying a new home in North Bay that is advertised for $372,850, that $372,850 is net of rebates. The price before rebates is $400,000, but under the current system is eligible for a $3,150 federal rebate and a $24,000 provincial rebate, bringing the after-rebate price down to $372,850. This model offers numerous benefits. The buyer does not have to navigate the rebate system, nor do they need to calculate the price after rebates have been applied. The seller gets to advertise a lower price, as the amount of rebates reduces the overall price.

These rebates only apply to new homes, as HST is not paid on existing homes, so there is nothing to rebate. As well, rebates can only go to an individual (not a corporation or partnership), and the home must be used “as the individual's, or their relation's, primary place of residence”, though there are other rebates with different criteria, such as the New Residential Rental Property HST Rebate.

This raises the obvious question, “How much would homes cost under a revised rebate system?” Let’s do the math.

A $900,000 home drops to $800,000 under revised rebates

The most common proposal is that both the federal and provincial governments would offer a 100% rebate on homes under $1,000,000. For the federal rebate, it would phase out between $1,000,000 and $1,500,000. In contrast, for the provincial rebate, the maximum amount would be $80,000 for a home valued at $1,000,000, and homes valued at more than that would also receive $80,000.

To model the impact of this change on home prices, we should also incorporate land transfer taxes. Ontario has a graduated land-transfer tax (LTT), with the following rates:

amounts up to and including $55,000: 0.5%

amounts exceeding $55,000, up to and including $250,000: 1.0%

amounts exceeding $250,000, up to and including $400,000: 1.5%

amounts exceeding $400,000: 2.0%

amounts exceeding $2,000,000, where the land contains one or two single family residences: 2.5%.

The City of Toronto has its own Municipal Land Transfer Tax (MLTT), which matches these rates, with additional brackets for homes valued over $3,000,000. Homebuyers in the City of Toronto must pay both the provincial and federal LTT. Partial rebates are available for first-time homebuyers, but, unlike British Columbia, there are no rebates for new homes.

This provides us with four scenarios to examine:

New homes purchased outside of the City of Toronto by non-first-time buyers.

New homes purchased inside the City of Toronto by non-first-time buyers.

New homes purchased outside of the City of Toronto by first-time buyers.

New homes purchased within the City of Toronto by first-time buyers.

We have developed another calculator to enable users to estimate prices for these four scenarios under various rebate conditions.

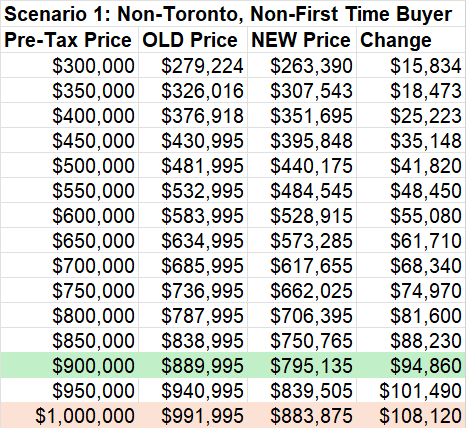

Under the first scenario, a home that would cost $889,995 after rebates and land-transfer tax would fall to under $800,000, resulting in a savings of nearly $95,000.

Figure 1: Home prices in Ontario, outside of the City of Toronto, for non-first-time buyers under a revised HST rebate plan. OLD Price and NEW Price are net of provincial and federal rebates, as well as land transfer taxes.

Source: HST Rebate Home Price Calculator.

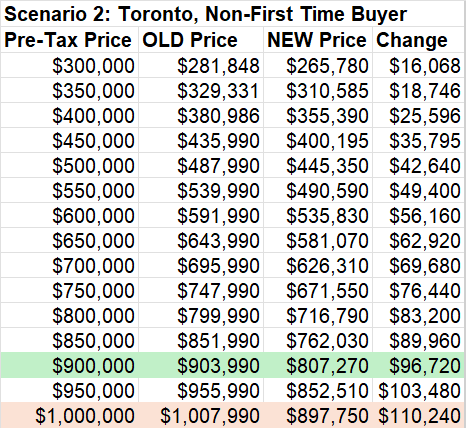

The savings are even larger in the City of Toronto, with post-LTT and rebate prices dropping by $96,720 under the same scenario. The larger drop is due to a reduction in LTT payable to the City.

Figure 2: Home prices in Ontario, inside the City of Toronto, for non-first-time buyers under a revised HST rebate plan. OLD Price and NEW Price are net of provincial and federal rebates, as well as land transfer taxes.

Source: HST Rebate Home Price Calculator.

A $100,000 savings on a new home would enable more families to qualify for mortgages, resulting in increased new home sales and the construction of additional homes. The impact would be instantaneous, as a revised rebate could take effect immediately, resulting in an immediate reduction in post-rebate prices.

Skeptics will naturally wonder, “Won’t homebuilders just raise prices by an offsetting amount, capturing the rebate for themselves?” That would be a legitimate concern in a hot market. However, in Ontario, home starts are cratering, single-detached home starts are at their lowest levels on record (with records dating back to 1955), and job losses are mounting. Revised rebates would address the cost-of-delivery crisis, allowing builders to offer homes at prices more families can afford, and help governments achieve their supply targets.

Revised rebates are win-win-win. Governments need to act.

Download a PDF of this article here: