The Coming Wave of 20,000 Job Losses in Vancouver’s Housing Sector

Policymakers are staring at starts, while sales show the collapse

Highlights

Housing starts data is misleading us: British Columbia’s housing starts data looks relatively strong, which has led policymakers into a false sense of security. Job losses have already occurred in the sector, with many more to come.

Housing starts mask real conditions: Housing starts serve as a lagging indicator, reflecting decisions made years prior. Projects counted as “starts” today were often financed and sold in 2021–2023, giving a misleading impression of present-day market health.

New home sales reveal the real downturn: New home sales, including both condominiums and single-family homes, have each declined by 80% compared to 2021 levels in the Greater Vancouver Area (GVA). Sales are the leading indicator of future construction, and the plunge signals a rapidly drying pipeline.

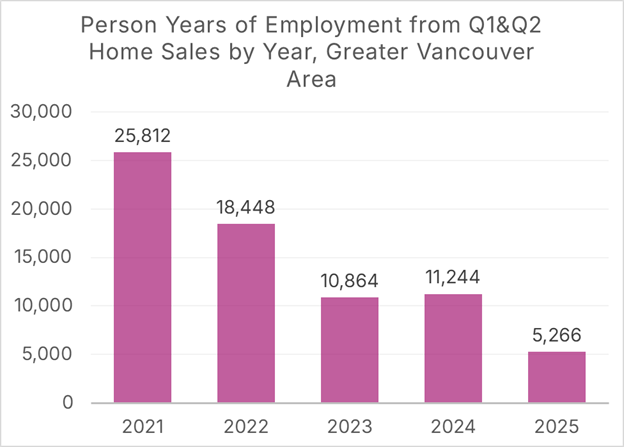

Employment impact already severe: Using Statistics Canada’s multipliers, the collapse in new home sales translates into a forecasted 20,000 person-year drop in employment in the GVA in just the first six months of 2025. These job losses stretch across construction trades, sales, design, and manufacturing supply chains. Much of this job loss has yet to occur, as it reflects future declines in housing starts.

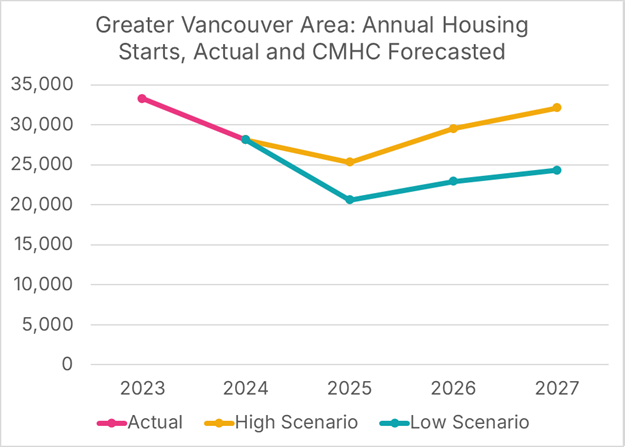

Implications for Canada’s housing goals: With CMHC forecasting fewer starts in 2027 than in 2023, even under optimistic scenarios, the federal goal of doubling housing starts is incompatible with the current jobs hemorrhage. Without urgent intervention, the GVA will bear a disproportionate share of employment pain, undermining national housing and economic objectives.

While the decline in housing starts and sales in Ontario has received considerable press, the Greater Vancouver Area’s housing market is also showing considerable weakness, leading to a reduction of 20,000 jobs from a reduction in new home sales in the first six months of 2025 alone.

Policymakers are not recognizing this weakness and job loss, as they are examining the wrong data.

B.C. housing starts are misleadingly strong

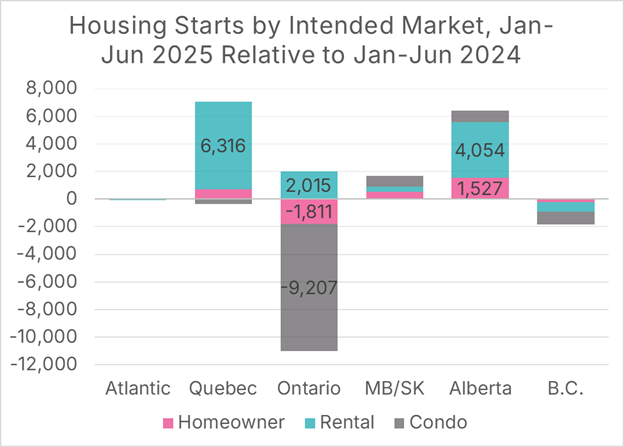

On the surface, Canada’s housing decline appears to be largely confined to Ontario. In the first six months of the year, housing starts in Ontario were down 9,000 units compared to the same period last year, whereas the decline in British Columbia was less than 2,000 units. Using our Statistics Canada employment multipliers, we find that Ontario’s slowdown in housing starts in the first six months of 2025 has led to 18,500 fewer person-years of employment relative to 2024, whereas British Columbia has experienced a more modest reduction of 2,150 years of employment.

Figure 1: Housing starts by intended market and region, Jan-Jun 2025 relative to Jan-Jun 2024

Data Source: CMHC Housing Information Portal, Chart Source: MMI

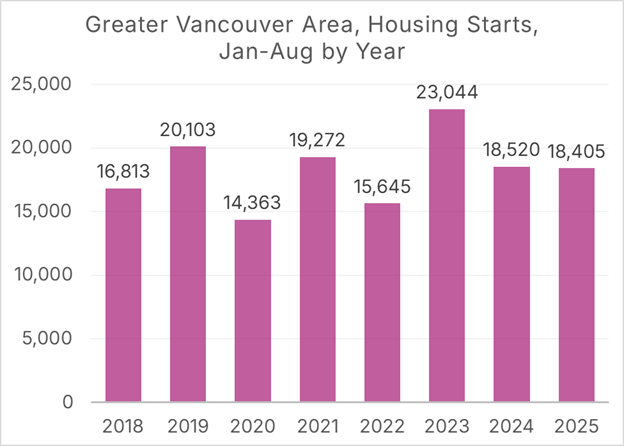

If we zoom in on the Vancouver Area, we find that housing starts in the first eight months of the year are nearly identical to those of last year and are in line with recent averages.

Figure 2: Greater Vancouver Area, housing starts, Jan-Aug by Year

Data Source: CMHC Housing Information Portal, Chart Source: MMI

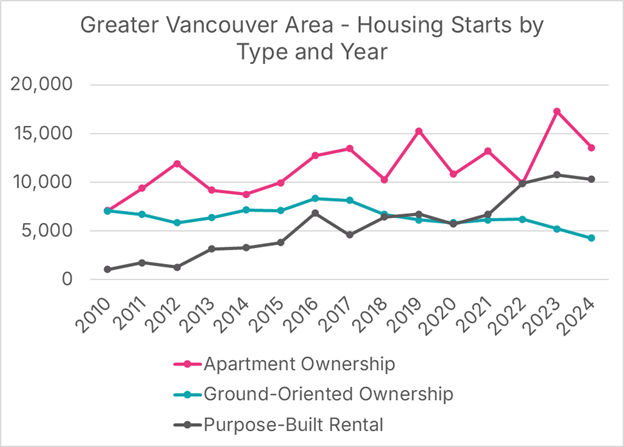

However, there has been a shift in recent years in the types of homes being built in the GVA. A decrease in apartment condo starts and a decade-long secular decline in ground-oriented ownership housing starts have been offset by a substantial increase in purpose-built apartment construction.

Figure 3: Greater Vancouver Area, housing starts by type and year

Data Source: CMHC Housing Information Portal, Chart Source: MMI

Housing starts as a lagging indicator

The relative flat level of housing starts is lulling us into a false sense of security. When it comes to the health of new housing construction, starts are what economists call a lagging indicator. Because housing starts occur years after preconstruction sales and the decision to proceed (or not) on a project, they reflect past, not current, market conditions. Brad Jones of Wesgroup provided a case study of this phenomenon in a recent LinkedIn post:

For the past 580 plus days, our construction team at Wesgroup Properties has been building our Harlin project at River District. This month, that project counted as a Housing Start in CMHC's latest release…

October 2021 we applied for a Development Permit

June 2023 we launched pre-sales

Feb 2024 we made the decision to proceed with construction

September 2025 CMHC publishes this project as a housing start

The long gap between when construction started and when the building was counted as a housing start is not an error; it is inherent in how the Canadian Mortgage and Housing Corporation (CMHC), the agency responsible for collecting the data, defines a “housing start”. The CMHC does not count a housing project as a “housing start” until the foundation is complete and at grade.

Figure 4: Visual definition of a housing start

Source: CMHC Housing Start Presentation to AMO.

For a high-rise project (either a purpose-built rental or condominium), it can take years, relative to when the developer obtains financing, for the building to reach the level of completion required to be considered a “housing start”. As such, it serves as a lagging indicator of the health of the housing market.

New housing sales, not starts, tells the real-time story

For a more real-time indication of the market's health, we should be looking at new home sales, not housing starts. There are limitations to using sales data; it is incredibly difficult to obtain, as the CMHC does not publish this data, unlike housing starts. Furthermore, by definition, it excludes purpose-built rentals. Despite those limitations, it remains the best leading indicator we have of the health of the market.

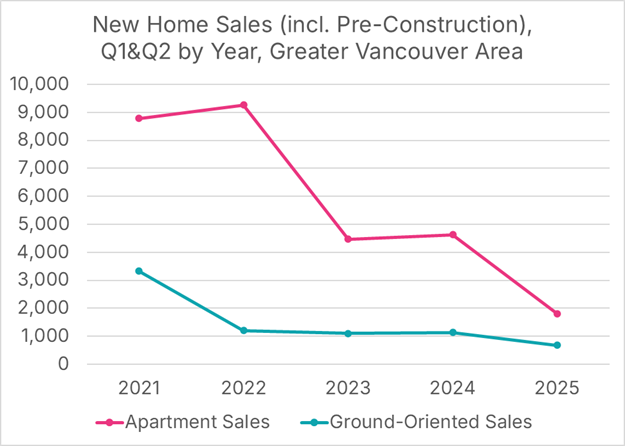

Numbers from Altus Data Studio indicate a massive decline in new-home sales in the Greater Vancouver Area. Relative to the first two quarters of 2021, both new apartment sales and new ground-oriented sales have fallen by 80%.

Figure 5: Greater Vancouver Area, new home sales, Q1&Q2 by year and type

Data Source: Altus Data Studio, Chart Source: MMI

Using Statistics Canada's multipliers, we estimate that this drop in housing sales has resulted in a reduction of over 20,000 person-years of employment, relative to 2021, in the first six months of 2025 alone.

Figure 6: Greater Vancouver Area, person-years of employment from new home sales, Q1&Q2 by year

Data Source: Altus Data Studio, Calculations and Chart Source: MMI

These employment estimates encompass both direct and indirect employment, covering a range of sectors, from construction to sales, as well as the impact of a reduction in housing construction on manufacturers of windows and doors. Much of this estimated job loss has yet to occur, as today’s pre-construction sale does not lead to a job for a roofer or plumber until a year or more into the future. Some employment, such as jobs in sales and design, creates a more immediate response, and we have already seen layoffs across some of British Columbia’s biggest builders and developers. Once the lack of sales translates into a lack of starts, more job losses will occur.

The CMHC recognizes that this lack of sales will result in a decline in starts and, ultimately, a decline in employment. They are forecasting that, even in the best-case scenario, housing starts in 2027 will be lower than those experienced in 2023. In the less optimistic scenario, starts will be nearly 10,000 units lower, in a country that has committed to doubling housing starts.

Figure 7: Greater Vancouver Area, annual housing starts, actual and forecasted

Data Source: CMHC Summer Update: 2025 Housing Market Outlook, Chart Source: MMI

Policymakers need to take a potential 20,000-person Vancouver-area job loss seriously

The employment situation in Canada is already precarious, with the number of Canadians receiving regular Employment Insurance benefits increasing by 13%, a 64,000-person rise, in the last twelve months. Previously, we estimated that the housing slowdown could result in 100,000 fewer jobs across Canada. This job loss would not be spread evenly across the country, with the Greater Vancouver Area suffering a disproportionate amount of the pain.

The last two paragraphs in Canada Risks Losing 100,000 Housing Jobs as Starts Collapse are worth repeating:

A loss of 100,000 jobs across Canada would be a substantial hit to our economy and the well-being of tens of thousands of families. When 15,000 jobs were at risk in the automotive sector after the 2008 financial crisis, federal and provincial governments understood the devastating impact this would have and acted aggressively to protect the sector.

The federal government, along with several provinces, have committed to doubling housing starts, but bricks do not lay themselves. If the industry continues to bleed jobs, these promises are little more than political theatre. The loss of 100,000 jobs would impact families and communities in the same manner as a factory closure. Reversing the housing start slide and ensuring that skilled workers don’t leave the industry forever is not just an economic necessity; it’s the only way those housing pledges stand a chance of becoming reality.