The Homeownership Journey Is Broken. Policymakers Need to Repair It.

Public policy needs to focus on repairing broken pathways

Highlights

Housing in Canada has a series of broken pathways.

Young people are having to live with relatives or multiple roommates longer due to a lack of rental options.

Homeownership rates, particularly for those under 40, are dropping across Canada as first-time homebuyers are increasingly priced out of markets.

The challenges for young families do not end there, as many are unable to transition from owning a one-bedroom unit to a three-bedroom (or larger) home suitable for raising children. This issue of second-time homebuyers is real, but policymakers virtually ignore it.

Similarly, bottlenecks that prevent seniors from downsizing can lead them to live in homes that do not meet their needs, and prevent their current, family-friendly homes from being transferred to the next generation of young families.

Policymakers need to find creative solutions to restore these pathways while also avoiding the creation of excess demand that would make housing even less affordable.

Too many Canadians are trapped

Policymakers need to focus on increasing the supply of new housing. When doing so, they should keep in mind the housing pathways middle-class families take, or would like to take, over their lifetime. Increasingly, those pathways have become blocked due to a lack of attainable options.

The ethos of the Missing Middle Initiative revolves around choice, which is reflected in our North Star:

Missing Middle Initiative’s North Star: A Canada where every middle-class individual or family, in every city, has a high-quality of life and access to both market-rate rental and market-rate ownership housing options that are affordable, adequate, suitable, resilient, and climate-friendly.

Middle-class individuals and families should be able to make the housing choices that are best for them, from the widest possible set of options. The middle class should have the option to choose between owning and renting a home. The middle class should have the option to live in any city they wish. No option should be seen as inherently superior to another, but the middle class should reasonably be able to get their preferred option. A family should own a home in Brantford because that is the best choice for them, not because of a lack of rental options or because they were priced out of their preferred city.

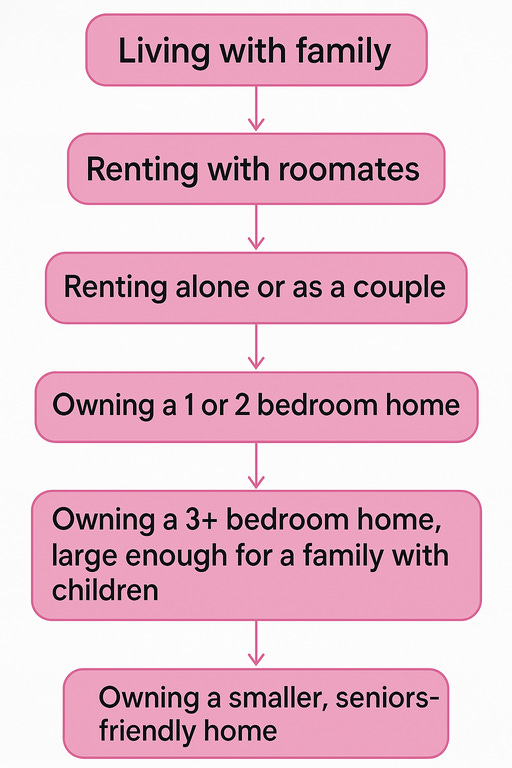

While no option should be seen as inherently superior (or inferior) to another, there is a housing pathway that is the preferred option for many in the middle class, which is shown by Figure 1.

Figure 1: One common middle-class housing pathway

Source: Missing Middle Initiative

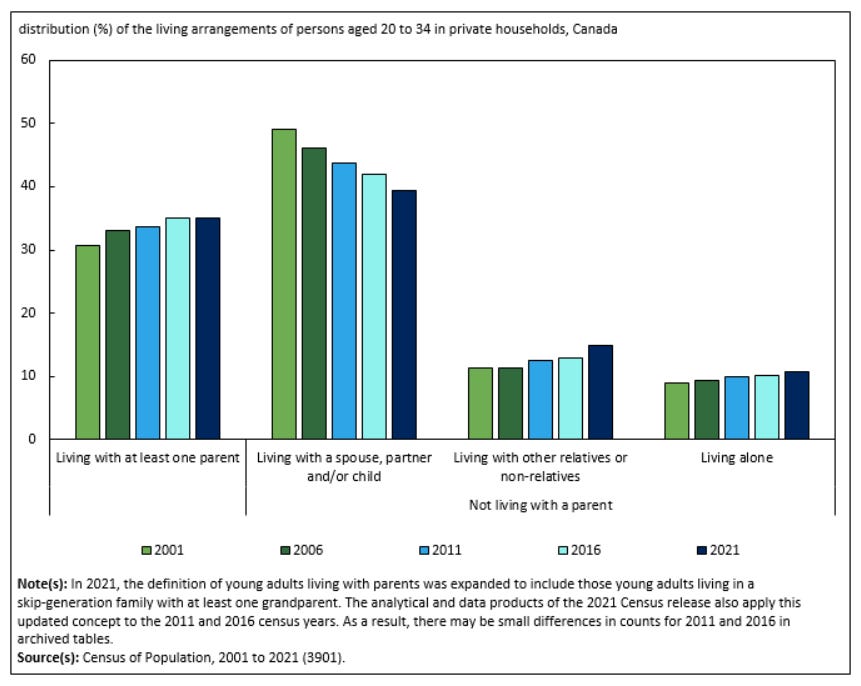

This pathway has become increasingly unattainable for Canada’s middle class. For example, it is almost certainly the case that high and rising rents have caused young, middle-class Canadians to live with their families or rent with roommates for longer periods. The Statistics Canada report Home Alone shows a substantial drop in the percentage of 20-34 year olds who live with a spouse, partner or child, and an increase in the number that live with at least one parent, other relatives, or non-relatives, as shown in Figure 2.

Figure 2: Living arrangement of persons aged 20 to 34 in Canada by year

Source: Home Alone.

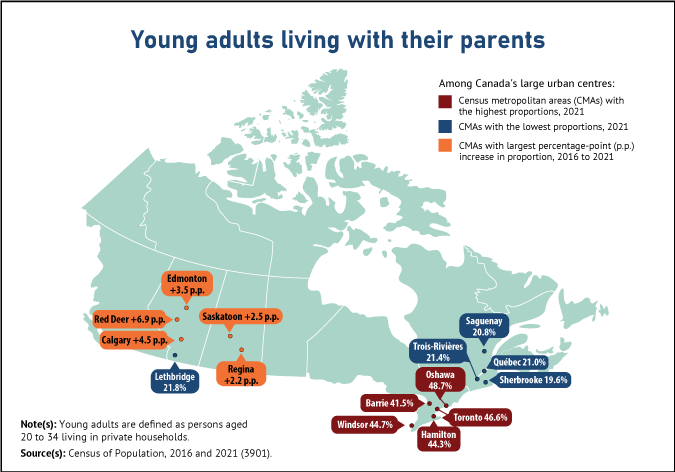

Unfortunately, this data can only tell us what happened; it cannot, by itself, tell us why. It may be that there is an increased preference towards living with parents, in which case, it is completely compatible with our ethos around choice. However, it is almost certainly the case that some of this change is due to a lack of affordable and suitable housing options, particularly given that the communities with the highest proportion of adults living with their parents are in the high-cost communities of Southern Ontario.

Figure 3: Proportion of young adults living with their parents

Source: Home Alone.

Young renters are being blocked from becoming owners

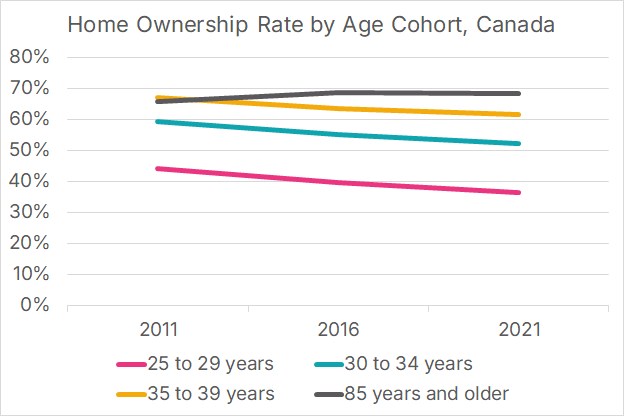

The Statistics Canada report “To buy or rent” paints a stark picture of the decline in homeownership for those under 40. In 2011, the homeownership rate for those aged 35 to 39 was higher than for those over the age of 85. While the ownership rate has stayed high for the older group, it has declined substantially for those under the age of 40, as shown in Figure 4.

Figure 4: Home Ownership Rate by Age Cohort, Canada

Source: Author’s Calculation, from data in To buy or rent.

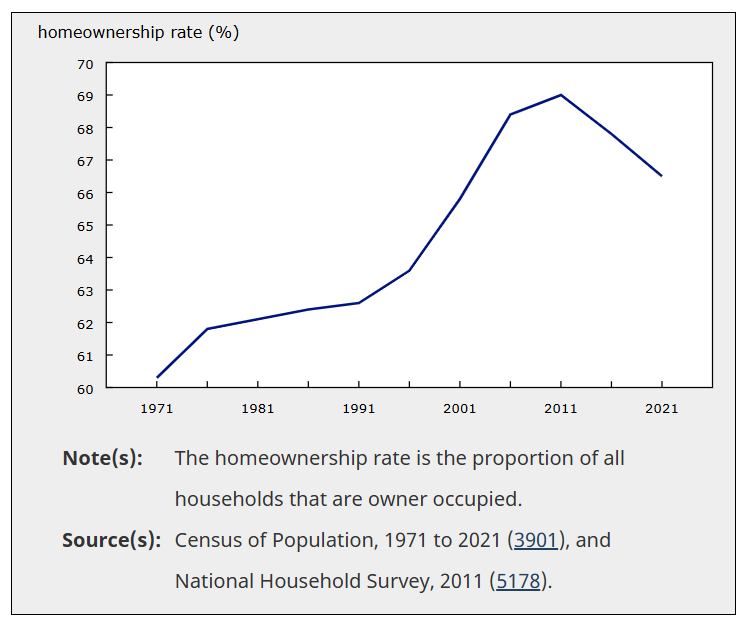

The overall homeownership rate in Canada peaked in 2011 and has been in decline since, primarily due to a decrease in homeownership rates among individuals under the age of 40.

Figure 5: Home Ownership Rate in Canada

Source: To buy or rent.

One particular source of frustration for young people who would like to own is that, for many, their monthly payments would not change all that much if they went from renting a home to owning a similar home, but they cannot do so simply because they cannot save up enough for a down payment. Policymakers have created several programs to address this issue, such as the First Home Savings Account (FHSA), to help young people obtain a sufficiently sized down payment. But far more needs to be done to address these barriers and the cost-of-delivery crisis, while respecting government budgetary limitations and ensuring these policies help create new supply, not just increase demand for existing homes.

Governments have all but ignored second-time homebuyers

Policymakers have acknowledged the challenges facing first-time homebuyers, as evidenced by announcements such as the federal government’s First-Time Home Buyers’ GST Rebate. However, in so doing, they often overlook what the Missing Middle team calls the “second-time homebuyers’ problem”.

On our sample middle-class housing pathway, second-time homebuyers transition from owning a small, often one-bedroom or studio high-rise condo unit to a three-bedroom home suitable for raising a family with children. Often, they have accumulated enough equity in their current home to meet down payment requirements; their issue is that they cannot qualify for a mortgage because home prices are so high, making monthly mortgage payments unaffordable. And when prices rise faster than incomes, the longer they wait, the more out of reach those homes become.

The cost-of-delivery crisis and regulatory barriers have caused new three-bedroom homes to become a thing of the past, particularly in Ontario, as we showed in The Baby Bust and the Death of the Three-Bedroom Ownership Home. Smart public policy can help address this, including enhanced HST New Housing Rebates. And getting more of these families into right-sized homes can free up smaller condo units for the next generation of young Canadians. However, this problem won’t be solved until governments recognize that Canada has both a first-time homebuyer and a second-time homebuyer problem that need to be addressed.

Finally, we need both on-ramps and off-ramps

Policymakers should also consider the phenomenon housing analysts call “involuntarily overhoused”, that is, families who live in larger homes than they would like, but structural barriers prevent them from moving into housing that better suits their current preferences and needs. Often, the issue is a lack of senior-friendly housing options, coupled with high transaction costs, such as the GST and land-transfer taxes, that disincentivize downsizing. This is why, in our view, the federal government’s revised GST Rebate should be extended to seniors who wish to downsize. Not only would this help increase the supply of seniors’ friendly housing, it would also free up larger, child-friendly homes for the next generation of families. Various barriers prevent or diminish seniors' ability to downsize, and smart public policy can help address these in a way that does not add extra demand fuel to the housing fire.

A focus on pathways helps markets create the right type of supply

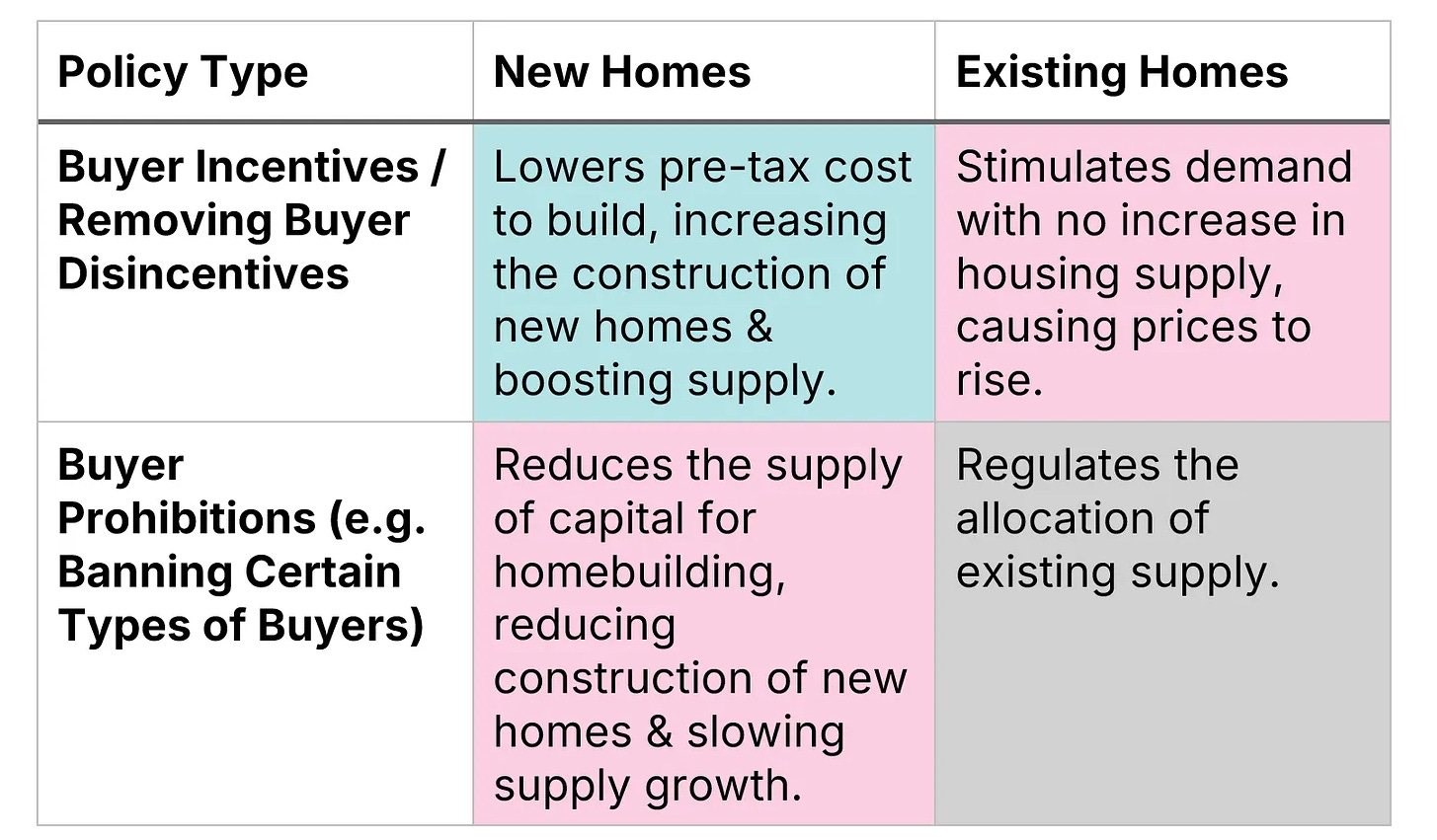

When we published “New Homes are the Solution: Policy Must Treat Them Differently”, feedback was overwhelmingly positive, and readers found the policy categorization matrix particularly useful.

Figure 6: Impact of housing policies on home type, expressed as a 2x2 matrix

Source: New Homes are the Solution: Policy Must Treat Them Differently.

However, a few readers were concerned that good-faith supply-side policies (in the green quadrant) might cause the market to create the wrong type of supply. Well-designed public policies that focus on housing pathways can help prevent that. In particular, we must focus on pathways that are often overlooked, including the barriers faced by second-time buyers.