Is Ontario Ready to Spend $895M to Jumpstart Homebuilding?

Calculating the cost of action and considering the cost of inaction

Highlights

Currently, a proposal exists for both the provincial and federal governments to enhance the existing GST/HST New Housing Rebate, providing owner-occupier purchasers of newly built homes with up to $50,000 in federal rebates and $80,000 in provincial rebates.

Using CRA data from 2023, we find that 24,000 homes were eligible for the provincial rebate and received an average rebate of just under $24,000. Under a revised provincial system, the average rebate would rise to over $60,000, and the program's annual cost would increase by $895 million, from $577 million to $1.472 billion.

Using the same data, we find that fewer than 2000 new homes in Ontario in 2023 were eligible for the existing federal rebate, as the program was never indexed for inflation, despite promises to do so. The current average rebate is under $3,000, and the total federal program cost in Ontario is $5.7 million.

A revised federal rebate program would allow for 22,000 of the 24,000 homes to receive a partial or full rebate. The average federal rebate size in Ontario would rise to just over $32,000, and the fiscal cost to the federal government on homes sold in Ontario would rise to $714 million.

Across all 24,000 eligible new homes, these reforms would increase the average combined rebate from $24,121 ($23,886 provincial + $238 federal) to $90,464 ($60,916 provincial + $29,548 federal).

While these reforms have a cost, we must also recognize the cost of inaction. Housing starts are slowing down, particularly in the Greater Toronto and Greater Vancouver areas, and job losses are mounting.

When answering a question generates another question

Last week, we examined the cost of extending the federal government’s proposed First-Time Home Buyers’ GST Rebate to all owner-occupier purchasers, finding that annual costs would jump from $300-400 million to $2 billion, a roughly $1.6 billion increase.

This led to the question, “What would the cost be to Ontario if Premier Ford made a similar move, given his indication that his government would match a federal reform?”

This is a relatively straightforward question to answer, using CRA data on the existing provincial HST new home rebate. Our estimate is $895 million per year, as expenditures on the rebate would rise from $577 million to $1.472 million.

To understand the math behind these estimates, it is essential to grasp how current rebates work.

How HST new home rebates currently work

As we wrote in “Is Doug Ford About to Slash $100K Off the Price of a New Home?”, current homebuyers in Ontario are eligible for two HST rebates on new housing:

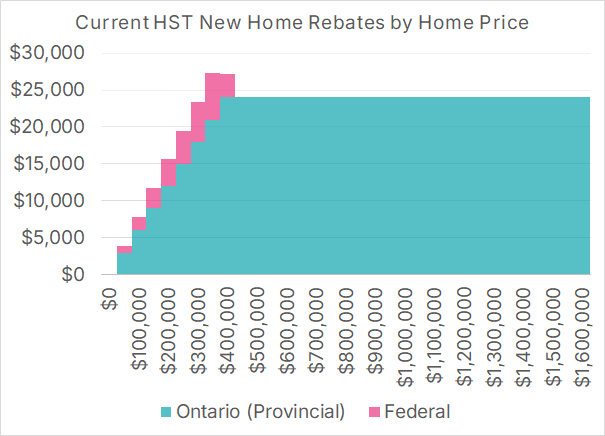

A federal rebate worth 36% of the federal portion of the HST paid on a home valued up to $350,000, creating a maximum rebate value of $6,300. This rebate is reduced for homes valued between $350,000 and $450,000. Homes valued over $450,000 receive no rebate.

A provincial rebate worth 75% of the provincial portion of the HST paid on a home valued up to $400,000, creating a maximum rebate of $24,000. Unlike the federal rebate, the provincial rebate is not phased out; instead, buyers of homes valued above $400,000 also receive $24,000.

The combined maximum rebate value is just over $27,000 for homes in the $350,000-$400,000 range, as shown in Figure 1.

Figure 1: Current HST New Home Rebates by Home Price

Source: Author’s Calculation

Three things to note about these rebates:

Their thresholds ($350,000, $400,000, $450,000) are so low because they are not indexed for inflation and have never been adjusted. The federal rebate has been unchanged since the GST went into effect on January 1, 1991, and the provincial rebate has been unchanged since the province adopted the HST on July 1, 2010.

Not all purchases of new homes are eligible for the rebate. The rebate can only go to an individual (not a corporation or partnership), and the home must be used “as the individual's, or their relation's, primary place of residence”, though there are other rebates with different criteria, such as the New Residential Rental Property HST Rebate.

The rebate only applies to the sale of new homes, as the sale of existing homes is HST-exempt to begin with. It also does not apply to purpose-built rentals, as they are eligible for a separate and full rebate.

In 2023, fewer than 2000 Ontario homebuyers received a federal rebate

Although housing completions range from 50,000-80,000 units in any given year, only 24,000 new homes in Ontario qualified for a rebate in 2023, according to CRA estimates obtained by the Missing Middle Initiative (with 2023 being the latest year in which data is available). The remainder of housing completions were ineligible either because they were purpose-built rentals (point 3 above) or because they were not sold to an individual for use as a primary place of residence (point 2 above).

The structure of the Ontario rebate, which has a rebate ceiling of $24,000 but no phase-out, means that all 24,000 of these homes were eligible for a rebate, and almost all of them were eligible for the full $24,000, as very few new homes in Ontario are valued under $400,000. The total fiscal cost to the provincial government in 2023 was approximately $577 million.

However, because homes valued over $450,000 are ineligible for the current federal rebate, fewer than 2,000 purchasers of new homes in Ontario were able to collect a federal new housing rebate in 2023. Of those who were able to collect a rebate, the average rebate size was $2,938, with a total cost to the federal government of $5.7 million. Note that this cost only incorporates homes sold in Ontario and not in any other province.

Because no federal government has ever lived up to the Mulroney-era commitment to index the housing rebate thresholds to inflation, the program has become irrelevant in Ontario. It is a vestigial tail from a bygone era.

It’s time to update these rebates for the modern era.

Modernizing the rebates can address the cost-of-delivery crisis

Under a modernized system, the eligibility criteria (individuals buying primary residences) remain, but the thresholds and rebate rates are increased. The proposal under consideration is as follows:

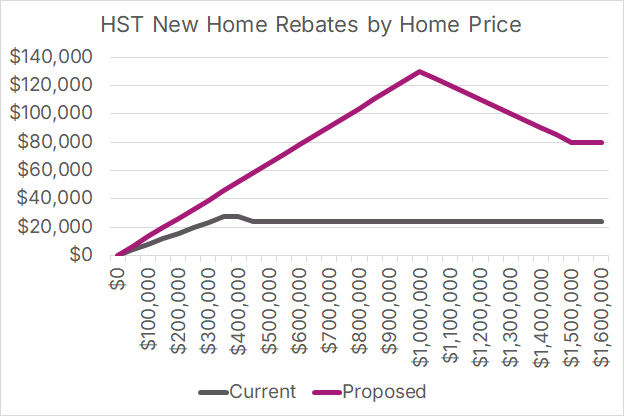

A federal rebate worth 100% of the federal portion of the HST paid on a home valued up to $1,000,000, creating a maximum rebate value of $50,000. This rebate is reduced for homes valued between $1,000,000 and $1,500,000. Homes valued over $1,500,000 receive no rebate.

A provincial rebate worth 100% of the provincial portion of the HST paid on a home valued up to $1,000,000, creating a maximum rebate of $80,000. Unlike the federal rebate, the provincial rebate is not phased out; instead, buyers of homes valued above $1,000,000 also receive $80,000.

Figure 2 shows the relative size of the proposed federal + Ontario rebate, for any given home price, relative to the current rebates.

Figure 2: Proposed HST New Home Rebates by Home Price

Source: Author’s Calculation

Using the same CRA data, we estimate the effect of the change on government finances. For the province of Ontario, this would increase the average rebate size to just over $60,000, and increase provincial expenditure to an estimated $1.472 million per year. Given that the existing expenditures are $577 million, the net increase is $895 million per year.

There would be a substantial increase in the number of people eligible for the federal rebate. Just over 17,000 individuals would be eligible for a full rebate, as they purchased homes valued under $1,000,000, and an additional 4,500 would receive a partial rebate, having purchased a home valued between 1 and 1.5 million. Roughly 22,000 of the 24,000 buyers in Ontario would receive some level of rebate, with an average rebate size of just over $32,000. This would increase annual federal expenditures on the program in Ontario from $5.7 million to $714 million, an increase of $708 million. Note that this does not include expenditures in other provinces.

Need to consider both the cost of action and the cost of inaction

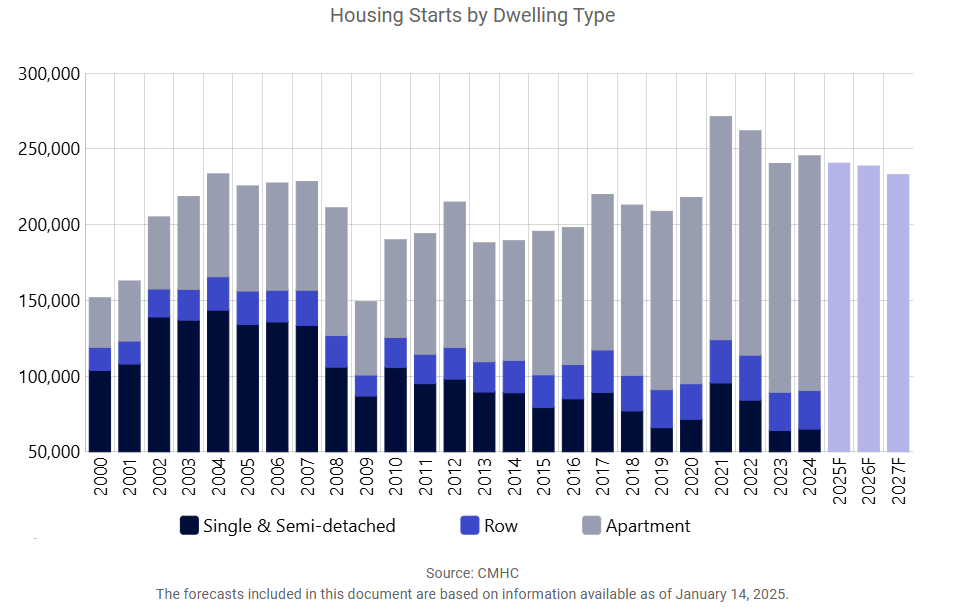

We recognize that governments have competing priorities and limited funds, and the costs involved in enhancing the GST/HST new housing rebate ($895 million for the Government of Ontario, and $714 million for the federal government in Ontario alone) are not trivial. However, we must also recognize that both the federal and provincial governments have set ambitious targets to double housing starts over current levels, at a time when the CMHC forecasts that starts in Canada will decline in each of the next three years.

Figure 3: Past and Forecasted Housing Starts in Canada

Source: 2025 Housing Market Outlook

Enhancing housing rebates will help address the cost-of-delivery crisis and help stave off mounting job losses in the sector. We must consider the cost of inaction and its implications for housing starts, employment, and tax revenue if governments fail to address the current crisis adequately.

We have seen politicians recognize the cost of inaction in housing. The Mayor of Vaughan, Stephen Del Duca, recognized this dynamic when the City cut development charges in half, with the Mayor stating:

“…if you start to cut anticipated revenues, that you might have a bit of a challenge I will say on the back end. The problem is, the last couple of years in our city [Vaughan] and I suspect it's true in most GTA municipalities, there hasn't been a ton of new housing starting. So, one of the reasons why I was comfortable making these changes and I told myself and colleagues on council I would much rather that we get half of something than 100 percent of nothing.

The same logic applies here. While enhancing the rebates reduces (net) HST collected on those 24,000 homes, it will also increase homebuilding, help reduce job losses in the sector, and the fiscal cost will be partially offset through increased revenue from other taxes.

In short, allowing housing starts to fall has a fiscal cost as well. We cannot ignore the cost of inaction.

Download a PDF of this article here: