Ontario’s Record-Low Family Housing Should Set Off Alarm Bells

Annualized starts are running at barely 30% of the province’s housing target.

Highlights

Headline increase, weak reality: Ontario housing starts rose ~12% year-over-year in January 2026, but starts are a lagging indicator and remain below historical norms.

Family-sized homes have all but evaporated: Single-detached, semi-detached, and row starts hit a record-low January (1,020 units), underscoring the collapse in family-oriented housing supply.

Far off provincial targets: Annualized starts are under 54,000, barely 30% of Ontario’s 175,000-unit annual goal.

Construction downturn broadening: Starts have fallen each year since 2022 and are forecast to weaken further across Ontario and most of Canada.

Cost crisis driving supply risk: Falling home prices, coupled with still-elevated construction costs, are stalling new projects and threatening future shortages unless governments reduce building costs.

Good news with a ton of salt

Ontario received some good news today, as housing starts in January 2026 were up nearly 12% relative to the previous year. There are, however, four big caveats to this good news:

Housing starts are a lagging indicator of new housing construction activity.

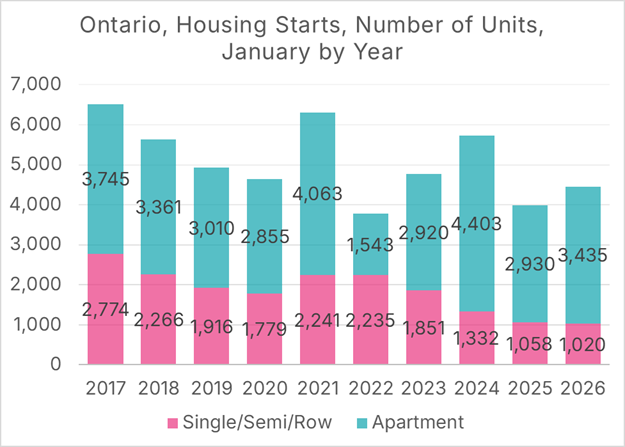

The total number of January starts, 4,455, is still below the 10-year January average of 5,045 (as shown in Figure 1).

The total number of ground-oriented housing starts (single-detached, semi-detached, and row housing) in January, 1,020, is lower than in any January on record, dating back to 1990.

Annualized, housing starts are under 54,000, only 30% of the province’s annual 175,000 start target.

Graphing this month’s figures against those of the previous nine Januarys illustrates the relatively modest nature of this increase.

Figure 1: Ontario housing starts, number of units, January of each year

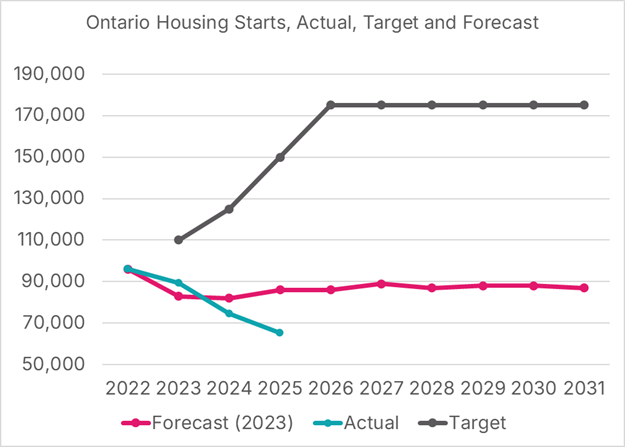

We also need to be clear-eyed about how far away Ontario is from hitting its housing targets. In 2022, to much fanfare, the government of Ontario released their 1.5 million over 10 years housing target, a number we estimated was appropriate given the level of population growth the province was expected to experience over that period.

Ontario keeps sliding further away from its targets

With less fanfare, the provincial government also released annual housing targets covering the years 2023 through 2031. These were nearly impossible to find online but were provided to municipalities as part of the Building Faster Fund and appeared in some memos and slide decks used by the province. It shows that annual housing targets would start at 110,000 units in 2023, increase to 175,000 by 2026, and remain at 175,000 through 2031.

In 2024, news outlet The Trillium obtained government documents indicating that private-sector forecasters projected housing starts would range from 80,000 to 90,000 units per year from 2023 to 2031, well below the 175,000-unit annual target covering 2026-31. A graph from one of those documents is shown in Figure 2.

Figure 2: Ontario housing start target and forecast by year

Source: Government of Ontario via The Trillium.

Unfortunately, those private-sector forecasts proved overly optimistic. Housing starts in Ontario have fallen each year since 2022, with starts reaching 65,000 in 2025.

Figure 3: Ontario housing start target, forecast, and actual by year

Data Sources: Government of Ontario via The Trillium, CMHC Housing Market Information Portal. Chart Source: MMI.

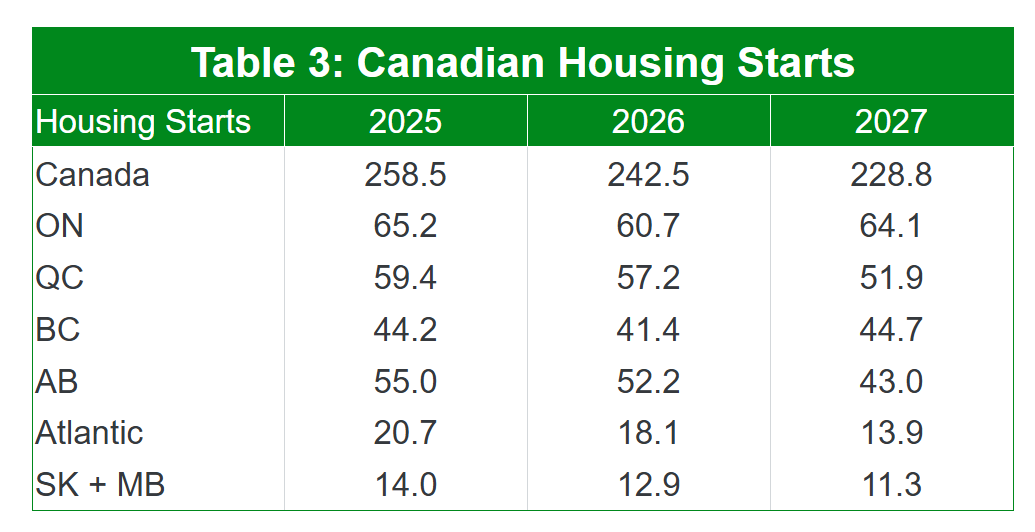

Not just a Toronto and Vancouver problem

Despite the year-over-year increase from last January, TD Economics and the CMHC project that conditions will worsen in Ontario before they improve. A recent report by TD forecasts that housing starts in Ontario will fall again in 2026, with 2027 starts remaining below 2025 levels. Ontario will at least have some company, as the TD report forecasts that starts in 2027 will be lower than in 2025 for every region of the country except British Columbia.

Figure 4: Forecasted housing starts by province and year

Data Sources: Government of Ontario via The Trillium, CMHC Housing Market Information Portal. Chart Source: MMI.

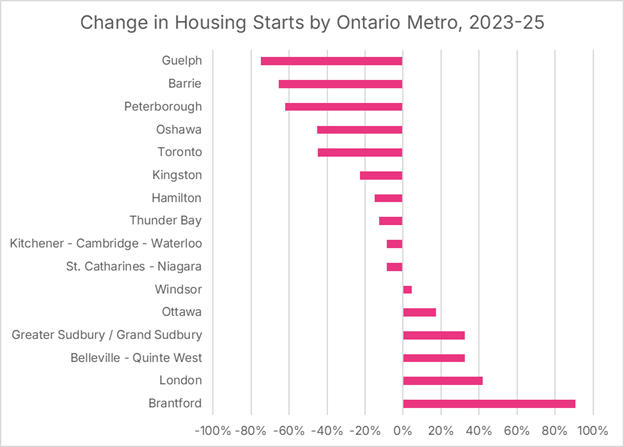

There is a common belief that Canada’s new housing weakness is simply a problem in Vancouver and Toronto. The TD report shows that, even if that were true today, that weakness is spreading across the country, a phenomenon we discussed in a January Maclean’s Magazine piece. While it is true that, in Ontario, the majority of the decline, measured in units, occurs in the GTA, this is largely due to the region’s disproportionate market share. In percentage terms, the Toronto CMA has experienced only the 5th-largest decline in housing starts since 2023, with Guelph, Barrie, Peterborough, and Oshawa experiencing even larger declines.

Figure 5: Change in housing starts, in %, from 2023 to 2025, by Ontario metro

Data Source: CMHC Housing Market Information Portal. Chart Source: MMI.

A province can’t thrive on purpose-built rentals alone

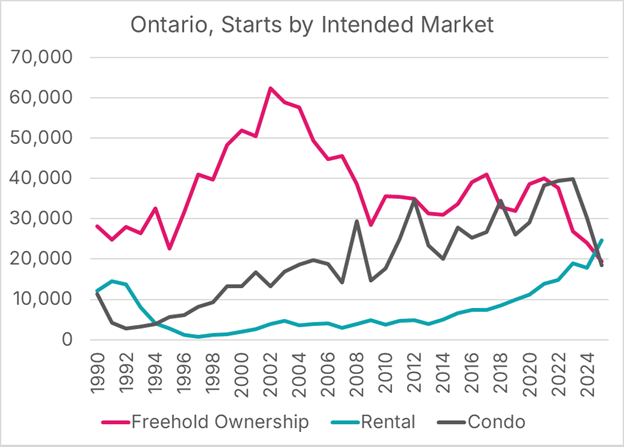

Simply examining unit counts obscures the extent of the problem, because a housing unit can range from a studio condo to a four-bedroom home. By disaggregating housing starts by intended use, we find that both condominium and freehold ownership starts are in freefall, whereas purpose-built rental apartment starts continue to rise. Rental apartments are the one leg of Ontario’s new housing stool still functioning, but with rents falling across the province, and the cost of new construction at all-time highs, there is a real risk that it may follow a similar fate.

Figure 6: Ontario, housing starts by intended market by year

Data Source: CMHC Housing Market Information Portal. Chart Source: MMI.

A province can’t thrive on purpose-built rentals alone

Ontario’s problem is simple: While the price of housing has fallen (a good thing for affordability!), the cost of building new homes has not, so new builds cannot compete with resale, and new rental apartments may soon struggle to compete with existing units. This creates a real risk that we enter a period of slow-to-no housing construction, which will result in a housing shortage when demand rises (either because the economy improves, interest rates fall, or immigration rates rise again), causing prices and rents to surge.

The only way to achieve sustainable long-run affordability is for the cost of new housing construction to fall further than prices. Eliminating the HST on new housing construction would be a good start, along with the other nine recommendations in A Blueprint to Restore Homeownership for Young Canadians. Ultimately, the government of Ontario needs to treat this situation as the crisis it is and introduce a suite of measures designed to lower the cost of homebuilding.