The GTA’s Housing Collapse: Governments Lose $6B+ Annually

Updated forecasts show governments still bleeding billions from housing decline

Highlights

New numbers: Earlier this year, we estimated that governments would lose over $6 billion in tax revenue from declining owner-occupied housing construction in the GTA. We decided to re-run the numbers using a recent CMHC forecast and more conservative per-home tax revenue estimates.

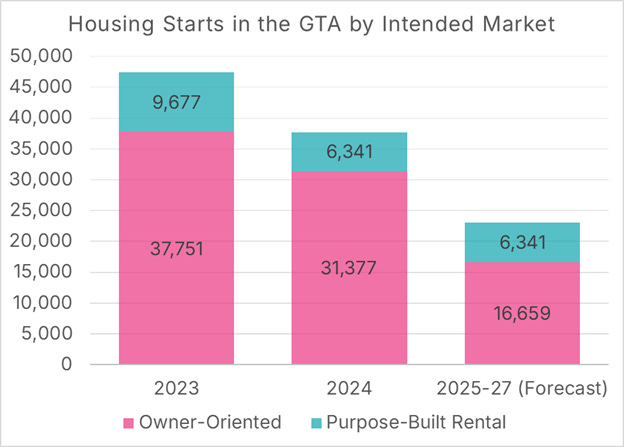

CMHC’s bleak forecast for the GTA: GTA housing starts could fall from nearly 48,000 in 2023 to just 23,000 annually in 2025–27, with less than 17,000 of those being owner-occupied homes each year.

Governments will experience a significant decline in revenue from this drop: We estimate that owner-occupied starts in 2023 generated an eventual $10.8 billion for governments. By 2025–27, comparable starts fall to just $4.8B annually.

Over $6B in annual losses: Compared to 2023, governments collectively lose over $6 billion per year, with the federal government down nearly $2.4 billion, provinces over $1.9 billion, and municipalities $1.7 billion.

Reduced HST revenue: Governments have been reluctant to introduce enhanced HST rebates due to fiscal concerns. However, we show that HST tax revenue from reduced home construction in the GTA alone will cost the federal and provincial governments $900 million a year in lost HST revenue. Both action and inaction have a fiscal cost.

The policy trade-off: Maintaining high construction taxes maximizes revenue per home but hinders building, job creation, and middle-class affordability. Reducing taxes could unlock a greater housing supply, offset revenue losses, and better align with commitments to double the number of starts.

Re-running the numbers

Our July 2025 piece Toronto’s Housing Collapse Will Cost Governments $6.6 Billion a Year has generated more thoughtful questions than anything else MMI has published since our founding. The piece examined the potential revenue loss from the reduction in housing pre-sales in the Greater Toronto Area (GTA). Readers appear to share our wonkish interest in how the fall in housing starts will impact government finances.

There were two questions that readers seemed particularly interested in:

How large are the projected tax revenue losses if you use CMHC’s housing starts forecast, rather than those provided by Altus?

How much revenue is each order of government projected to lose?

Let’s address these issues one at a time.

The CMHC’s bleak housing start forecast for the GTA

In late July, the CMHC issued a projection indicating that housing starts for the GTA, which had already declined from 47,428 units in 2023 to 37,718 in 2024, could drop as low as 23,000 units for each of 2025, 2026, and 2027.

Unfortunately, they did not break this projection down into owner-oriented and purpose-built rental housing, which is a problem, as our original piece examined the decline in owner-occupied housing. Purpose-built rental starts were 9,677 units in 2023 and 6,341 units in 2024. Given the relative strength of purpose-built rental starts, we will assume that purpose-built rental starts remain at 6,341 per year.

This assumption would yield projections of 16,659 owner-occupied housing starts for each of the years 2025, 2026, and 2027.

Figure 1. Housing starts in the GTA by intended market

Data Source: CMHC, Chart Source: MMI.

As of August 2025, the GTA is on pace to have 7,644 purpose-built rental starts and 17,032 owner-occupied housing starts, the latter of which is nearly identical to the projection in Figure 1.

Using more conservative revenue assumptions

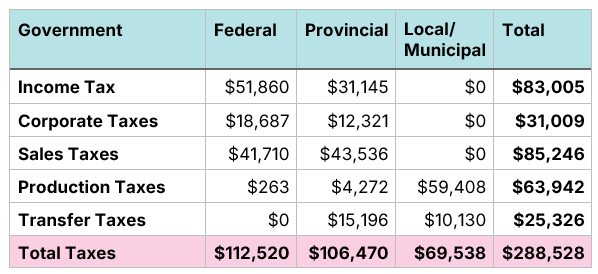

Unfortunately, the 2024 CANCEA study, used in the previous piece, does not contain a breakdown of tax revenue by government per house sold. Their 2023 study, however, did include that information so that we will use those numbers in our analysis. The tax revenue per home estimates are substantially lower, in part because the 2023 study assumes a lower average home value ($940,000 in the 2023 study, compared to $1.07 million in the 2024 study). Given the recent fall in GTA home prices, a lower home price assumption is reasonable. This distinction shows that government revenue not only depends on the number of new homes built, but their price. Government tax revenue from new home construction is being reduced through a decrease in home construction and a decline in the average new home price.

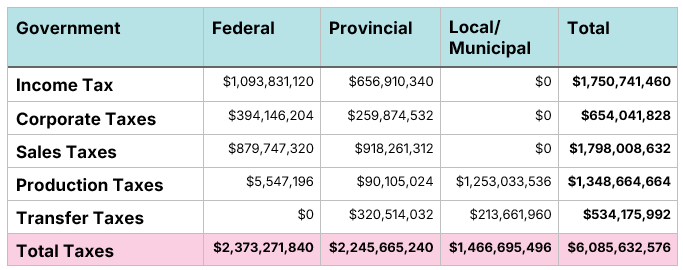

Figure 2. Estimated tax revenue on a new $940,000 home in Ontario, by order of government

Chart Source: CANCEA.

To estimate the revenue each government collected from owner-oriented home starts in 2023, we can multiply each number in Figure 1 by 37,718, the total number of owner-oriented home starts in 2023. Of course, each home would generate a different level of tax revenue, but the estimates in Figure 2 represent the average home sold, so these differences will “average out” in the final calculation.

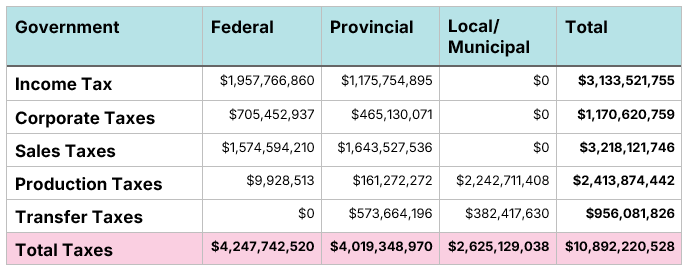

We estimate that 2023 owner-occupied housing starts in the GTA generated $10.8 billion in revenue for governments, with the federal and provincial governments collecting over $4 billion each, and municipal governments receiving over $2.6 billion. There is a crucial distinction here: these figures do not represent the amount of tax revenue collected by these governments in 2023, as most of these units would not be completed and paid for during that calendar year. Additionally, development charges (which are included in “production taxes” on Figure 2) are often paid a year or more before the CMHC counts a building under construction in their housing start data. The estimates in Figure 3 represent the amount of tax revenue that 2023’s housing starts will eventually yield for the government, rather than taxes collected in 2023.

Figure 3. Estimated total tax revenue on 16,659 owner-oriented housing starts for the GTA, for 2023, by order of government

Chart Source: MMI.

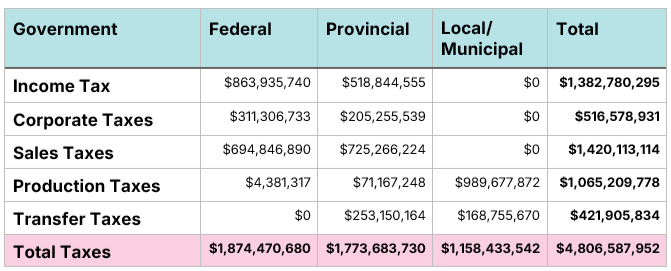

We can then conduct a similar exercise to estimate tax revenue for owner-occupied housing starts in each of 2025, 2026, and 2027. We will assume 16,659 owner-occupied housing starts for each of those three years, and that prices stay unchanged. This is a conservative assumption; prices will almost certainly be substantially lower in those years relative to 2023, resulting in an even larger drop in tax revenue collected.

In this new scenario, overall annual tax revenue drops to $4.8 billion, with each order of government collecting less than $2 billion per year in revenue.

Figure 4. Estimated total tax revenue on 16,659 owner-oriented housing starts for the GTA, forecasted for 2025, 2026 and 2027, by order of government

Source: MMI.

Figure 5 shows that, relative to owner-occupied housing starts in 2023, starts in 2025-27 will generate $6 billion less in tax revenue each year, with the federal government experiencing a decline of nearly $2.4 billion. It is reassuring that, despite using different housing forecasts and slightly varying assumptions, we once again project an annual tax revenue decline of over $6 billion per year, as was the case in the earlier piece.

Figure 5. Reduction in estimated revenue between 2023 and 2025/2026/2027 from falling owner-oriented housing starts, by order of government

Source: MMI.

The fiscal cost of inaction

We have written extensively on the need to reduce housing construction taxes, including the HST, to lower the cost of new homes. While this does have a fiscal cost, so too does inaction. The federal government is set to lose $900 million each year in GST revenue from the GTA housing decline alone, far more than the projected cost of their first-time homebuyers’ credit.

Governments have a choice to make. One path forward is to maintain high housing construction taxes, which generate substantial tax revenue per home. However, this approach prices out the middle class and results in fewer homes being built, putting 100,000 jobs at risk. Alternatively, they can reduce tax revenue per home, but allow those homes to be attainable for middle-class families, thereby creating a higher quality of life for Canadians. This can be offset by building more homes and creating additional jobs, thereby compensating for the lost tax revenue. Given that the federal government, along with several provinces, have committed to doubling housing starts, the “generating revenue through low tax rates and high production volumes” would appear to be the best fit.

Now is the time for expanded HST rebates for new homes.

Download a PDF of this article here: