Solving the Housing Supply Crunch: A 10-Step Plan for Federal Action

Recommendations from the Large Urban Centre Alliance

Urgent housing solutions for Canada’s largest cities

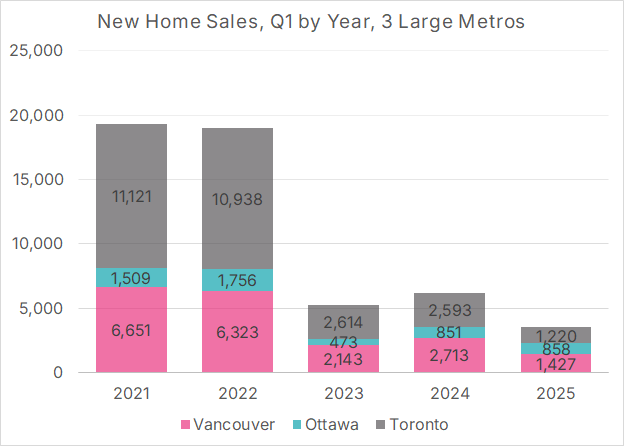

Canada has a goal to double housing starts, yet housing starts are falling in Canada’s two largest markets, and the sale of new homes has all but evaporated in the GTA, Vancouver, and Ottawa. Addressing this will require action from all three orders of government.

Earlier this summer, a group of 13 homebuilders operating in Canada’s six largest cities came together to form the Large Urban Centre Alliance, advancing solutions that support housing supply, infrastructure investment, and sustainable urban development. Details on the group can be found here.

The Alliance asked the Missing Middle Initiative to write a background report on the current state of homebuilding in our major cities, identify the issues that need to be addressed, and co-facilitate a process where the group would develop a set of policy recommendations for the federal government, in advance of the fall budget. Today, the group released their budget submission, along with the background report that MMI prepared, which is available for download at the bottom of this article.

The Alliance developed ten policy solutions to address two problems: The cost of building homes and a lack of capital. Four of the ten recommendations were identified as priorities, including reforming the GST/HST New Housing Rebate and instituting a Direct-to-Buyer development charge system.

The numbers are alarming

Each year, housing starts in Canada’s six largest metros represent 50-60% of all starts. Currently, new home sales have all but evaporated in three of those six cities, which will lead to further declines in housing starts. This decline is not just in condos; in the GTA, single-family homes have dropped by more than 70% from ten-year averages.

Figure 1: New Home Sales, Q1 by Year, Three Large Urban Metros

Data Sources: BILD, GOHBA, Zonda Urban. Chart Source: MMI

There are two problems the federal government can address to help boost housing starts: policies that lower the cost of homebuilding and policies that make it easier for homebuilders to access capital.

The only path to increased supply and enhanced affordability is lower costs

The only way to meet the twin goals of affordability and increased supply is through substantially lowering the cost of homebuilding. For example, the federal government’s focus on factory-built housing approaches, through Build Canada Homes, shows promise in reducing costs over time.

However, many of the government’s initiatives to lower these costs will take several years to bear fruit, and there is an immediate need to reduce costs, particularly in Canada’s large urban centers. The biggest direct lever that governments have to lower homebuilding costs is through taxes, though we should not overlook the impact that streamlining regulatory processes and accelerating approval processes can have on the cost of homebuilding.

These issues are examined in detail in the article "Why Lower Construction Costs and Taxes Are the Only Path to More Homes and Lower Prices."

Governments must also recognize the need to unlock $2 trillion in housing-related capital

Should efforts to reduce homebuilding costs be successful in reviving home sales in Canada’s largest markets, access to capital will likely be a limiting factor. A recent report from RBC finds that “Tackling Canada’s housing shortage will require $2 trillion in capital deployment over the next 5 years—that’s a 5X increase from current levels”.

There is no one single source that can provide this level of capital. Governments must remove barriers to attract and retain capital, while ensuring that rules, regulations, and outdated processes do not unnecessary encumber that capital. Capital will need to come from large investors, small investors, from outside Canada, and from governments themselves.

The capital attracted in this manner will not only facilitate the building of homes but also create jobs throughout the housing construction supply chain. The increased economic activity will provide a further boost to non-housing-related jobs and government tax revenue.

The group recognized that while housing is a priority, the federal government faces several constraints when designing policy. So these constraints were kept in mind as those policies were designed.

Working within the federal government’s constraints

The federal government does not have unlimited time and resources, and any new housing-related initiatives it introduces must be aligned with its vision, integrate well with current policies (including those yet to be implemented), while recognizing the constraints under which the government operates.

While designing and implementing new housing policies, the federal government must consider the following:

The promise to double housing starts. The federal government has committed to doubling housing starts, which would result in nearly 500,000 starts per year. Canada has never had more than 300,000 starts in any calendar year, so this will require a wartime-like effort. The government must be willing to take bold policy actions to achieve this goal, while also being prepared to abandon well-meaning policies that have a negative impact on housing starts.

The need for fiscal discipline. The federal government is currently seeking to substantially reduce operational costs to shrink the deficit and fund much-needed investments. When designing housing policy, the government must be fiscally disciplined while being willing to remove restrictions on homebuilding, which will generate both additional housing starts and additional tax revenue.

The need not to stimulate demand for existing homes. Currently, the average price-to-income ratio in Canada for a middle-class family to purchase a single-family home is over seven; 20 years ago, it was four. The government must avoid well-intentioned policies to reduce the demand for existing homes. It can achieve this by targeting policies that reduce the cost of building and purchasing a new home, rather than policies that have an overall stimulative effect on demand.

The group then designed policy recommendations to address the two challenges (cost and a lack of capital), taking into account those three constraints.

Priority recommendations to address the cost of building new homes

There is an urgent need to immediately reduce the cost of new home construction to address the immediate crisis. The federal government has several levers at its disposal to achieve this.

Recommendation 1: Substantially lower the price of new homes through a temporary three-year expansion of the existing GST/HST New Housing Rebate to provide a rebate of 100% of the GST on new homes valued up to $1 million, and a partial rebate for homes between $1 million and $1.5 million, but otherwise keeping the existing rebate criteria in place.

We have written numerous pieces on this topic, including "Is Ontario Ready to Spend $895M to Jumpstart Homebuilding?"

A combined federal-provincial revised HST rebate can cut the cost of a new home in Ontario by over $100,000 without stoking demand for existing homes, as the HST is only applicable to new homes. In a press conference yesterday, Premier Ford expressed his support for the idea.

Recommendation 2: Substantially lower the price of new homes by removing tens of thousands of dollars of interest costs, junk fees, and tax-on-tax from the cost of new homes by implementing a transparent direct-to-buyer development charge (DC) billing model that exempts DCs from HST and land/property transfer taxes and provides in-stream homebuyer protection from DC increases.

Details on this idea can be found in the article How a Direct-to-Buyer Development Charge System Can Save Homebuyers $68,000.

If provinces and municipalities adopted a model where development charges are directly charged to the buyer upon possession, tens of thousands of dollars in interest costs and junk fees could be avoided, and working capital would not be encumbered during the project. Furthermore, if governments treated these charges as a separate tax, they could exempt the charges from GST/HST and property transfer taxes, eliminating the unfair tax-on-tax on development charges. A transparent billing model would also enable buyers to know exactly how much they are paying in taxes and fees, thereby enhancing accountability. To ensure there are no surprises at closing, and to ensure these fees can be included in a mortgage, buyers must be provided with in-stream protection and be able to “lock-in” development charge rates when signing an agreement of purchase and sale.

While the federal government cannot directly create this model, it can require it as part of funding agreements with provinces and municipalities, and exempt development charges assessed in this manner from HST.

Priority recommendations to unlock $2 trillion in capital

By reducing barriers to attracting capital, the federal government can not only achieve closer alignment with its housing supply goals, but it can also generate much-needed tax revenue through the construction of additional homes.

Recommendation 3: Increase the capital available for purpose-built rentals and new condo construction by providing a GST/HST exemption for current rental developments under construction which are not eligible for the GST rebate, and by creating a foreign-buyer ban exemption for new and pre-construction homes, similar to Australia’s.

Details on the Australian foreign-buyer ban system can be found in the article New Homes are the Solution: Policy Must Treat Them Differently.

Recommendation 4: Increase the capital available for purpose-built rentals by building on the progress the federal government has made on new rental construction, by ensuring that ACLP is adequately capitalized to handle an increasing volume of applications.

CMHC’s ACLP financing vehicle has been one of the primary contributors to the rental construction boom Canada has experienced in recent years. The federal government should ensure that the program has enough capital to support further growth.

Secondary recommendations for the federal government to immediately address the cost-of-delivery crisis and remove barriers to capital

The four recommendations above were identified as priorities, as they are expected to have the largest and most immediate impact on addressing the current housing crisis. The report also includes an additional six recommendations. Recommendations 5 and 6 address the cost-of-delivery crisis, while 7 through 10 help increase the capital available for homebuilding.

Secondary recommendations to address the cost of building new homes

Recommendation 5: To accelerate the construction of new homes, tie federal infrastructure funding to pro-housing supply municipal reforms, such as accepting surety bonds in subdivision agreements and site plan agreements and implementing Edmonton-style automated approval programs.

For details on surety bonds, see Surety Bonds Could Unleash Billions Toward Canada’s $2 Trillion Housing Need.

Recommendation 6: To lower the price of new homes and increase the diversity of housing options available to Canadians, enforce the conditions set out in municipal Housing Accelerator Fund agreements.

Municipalities that fail to fulfill their HAF requirements pose a problem.

Secondary recommendations to unlock $2 trillion in capital

Recommendation 7: To unlock much-needed global capital into housing construction, fully exempt real estate and housing-related infrastructure investment from EIFEL rules, and conduct a full review of other federal housing-related taxes and regulations, including the OSFI mortgage stress test, to ensure they are designed appropriately for the current conditions.

Recommendation 8: To build much-needed missing-middle rental housing and to channel investor dollars towards new rental construction, launch consultations on the proposed Multi-Unit Rental Building (MURB) tax provision this fall, with the goal of ensuring that rental projects that begin construction on or after January 1, 2026, are eligible for the tax provision.

Our primer on the MURB program: The Quiet Death of the Investor Condo? MURBs May Change the Game.

Recommendation 9: To increase the capital available for MURB tax provision eligible projects, create a time-limited incentive for investors who currently own non-purpose-built rental properties who sell the units and reinvest the proceeds into a project eligible for the MURB tax provision.

Recommendation 10: To enable condo construction to be financed after small-scale investor dollars have been shifted towards MURB-eligible projects, enable banks to reduce pre-sale requirements on new condo developments via federal backstop facilities.

To learn more about the state of the current crisis and the role the federal government can play in addressing the crisis, see the full report, which is available for download below: