Ontario’s Development Charge Crisis In 10 Points

Everything you need to know about development charges and the housing crisis

Ontario is experiencing a housing crisis, and a primary contributor to the crisis is development charges (DCs). Politicians in all three orders of government have begun to recognize that development charges are too high. Municipal governments, such as Mississauga and Vaughan, made commitments to lower DCs. In their speech from the throne, the provincial government signalled their intent to reform the system, and during the federal election, all three major national parties made platform commitments to use federal spending powers to lower DCs across Canada.

Despite these commitments, it is not well understood by the public or the media why high development charges are a problem, or how Ontario found itself in this situation. Over the past few months, we have published a series of articles (scroll to the end to view the full list) examining various aspects of development charges and other municipal taxes on housing construction in Ontario.

There was an overwhelming amount of content in those pieces, so we thought we would provide you with a “cheat sheet” of all the content, following the structure of “Development Charges: 10 Things You Need to Know About Housing Taxes in Ontario,” one of our first pieces on the issue.

Ten Things Ontarians Need to Know About Housing Taxes

High housing taxes are a leading contributor to the housing affordability crisis.

High housing taxes are growing at an unsustainable rate.

High housing taxes are substantially greater in Ontario than in the rest of Canada.

High housing taxes reduce the supply of housing.

High housing taxes create a tax-on-tax for homebuyers.

High housing taxes are inflated because of phantom projects and other dubious assumptions.

High housing taxes have left billions of unspent dollars.

High housing taxes can be lowered.

High housing taxes are not inevitable because there are fairer and less expensive ways to pay for infrastructure.

High housing taxes pay for more than growth.

And here are the details.

1. High housing taxes are a leading contributor to the housing affordability crisis

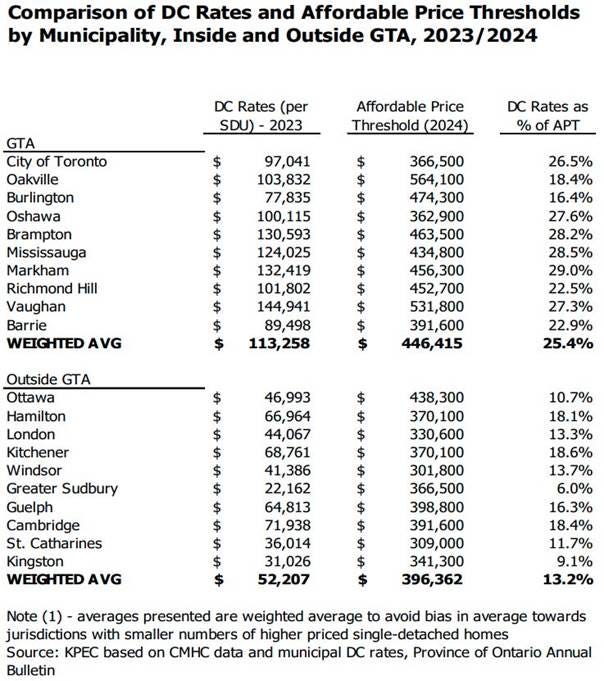

Development charges (DCs) are part of an alphabet soup of taxes we levy against homes, including other taxes like community benefit charges (CBCs), parkland fees, and other costs. DCs receive a lot of attention because they are typically one of the largest individual tax items, which, combined with other taxes, can make up around 25% to 30% of a home.

Development Charges for a two-bedroom apartment in Toronto are currently $80,690 per unit and are rising at a rate of 16.7% per year. This level of punitive taxation is simply incompatible with middle-class affordability and Canada’s commitment to treat housing as a human right.

If a developer wanted to keep the price of a home at a level affordable for families, the development charges alone would be over 25% of the house price in the Greater Toronto Area. The remaining 75% would have to pay for other taxes, land, construction of the house and, yes, builder’s profit.

Source: KPEC Consulting

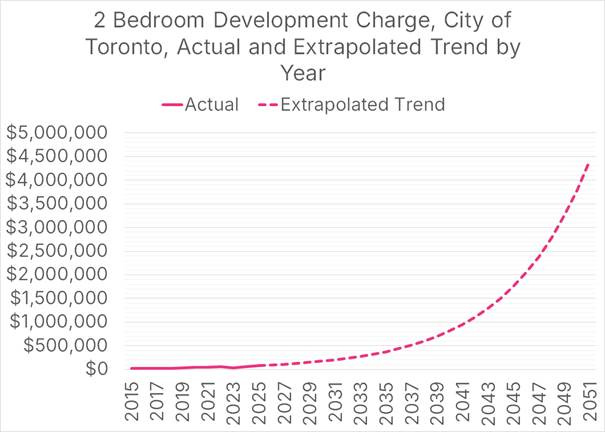

2. High housing taxes are growing at an unsustainable rate.

Municipalities are already making growth plans for the next 25 years. If development charges continue on the same growth path over the next 25 years as they have in the previous 25, they will exceed $4 million per home in some GTA municipalities. This is clearly unsustainable.

3. High housing taxes are substantially greater in Ontario than in the rest of Canada.

Development charges, related taxes, and fees on low-rise housing have increased by an average of 33% across Canada over the last two years. Ontario is an outlier in taxes for both new low-rise and high-rise housing, with the GTA having the highest fees anywhere in Canada. In addition, municipal housing taxes are substantially higher on a per-square-foot basis for high-rise than for low-rise housing, which is regressive and violates the spirit of “growth should pay for growth,” as figures from a Canadian Home Builders’ Association (CHBA) report show.

While some individual fees based on land values have decreased since 2022, such as parkland dedication and community benefit charges, the overall tax burden on new housing construction in Ontario has continued to rise, largely due to increases in development charges.

4. High housing taxes reduce the supply of housing.

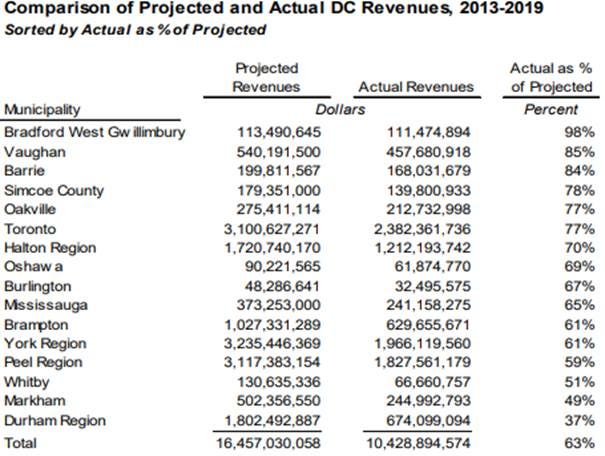

Development charges have several drawbacks as a revenue tool for municipalities. One drawback is predictability, as municipalities routinely collect and spend significantly less development charge money than they forecast.

Source: Altus Group Economic Consulting

One reason is that municipalities fail to account for price elasticity. When taxes on new development increase, the amount of new development decreases. Yet when setting development charges, they treat the amount of development as a constant, unrelated to price.

Municipalities may be setting development charges so high that they are forgoing revenue, leading to infrastructure delays and expenditure shortfalls, as well as failing to provide the homes needed to house their residents.

It was estimated that between 2006 to 2018, municipalities lost over $10 billion in taxes and fees do to a lack of homebuilding, along with missing out on 100,000 homes. Overly high development charges lead cities to build fewer homes and collect less revenue than in their plans.

5. High housing taxes create a tax-on-tax for homebuyers.

Because taxes on homebuilding are paid early in the process, typically when a builder obtains their building permit, before any excavation begins, the builder must then finance that tax because they do not receive payment until the home is completed.

After carrying these expenses for years and paying substantial interest on them, all the development charges and interest costs are ultimately embedded into the final price. When buyers purchase a home, they pay the GST, PST, and land transfer tax on top of the municipal taxes that are already embedded in the price. This creates a tax-on-tax on homebuilding, which further reduces the number of homes that are built.

6. High housing taxes are inflated because of phantom projects and other dubious assumptions.

Development charges are based on background studies, which a pre-requisite for municipalities to do before they can tax housing. These studies include numerous dubious assumptions, such as classifying projects that benefit existing residents as ‘growth-related’.

Dubious assumptions on the value of existing municipal assets create a doom-loop in development charge calculations, where increases in development charges increase the cap on development charges, which leads to even higher future development charges in a never-ending cycle.

Differences in assumptions about the number of homes to be built also inflate development charges, due to the way DC rates are calculated. The province set an explicit goal to build 1.5 million homes over 10 years, from 2022 to 2031. However, the province did not require municipalities to incorporate these targets in their planning, as they did with the now-defunct Growth Plan. As a result, most municipalities have disregarded their targets and instead employed less ambitious housing growth forecasts in their planning, which simultaneously raises DC rates and makes it more difficult to hit the provincial housing supply target. Cities, such as Brampton, are being transparent about the fact that they are not meeting provincial targets in their planning.

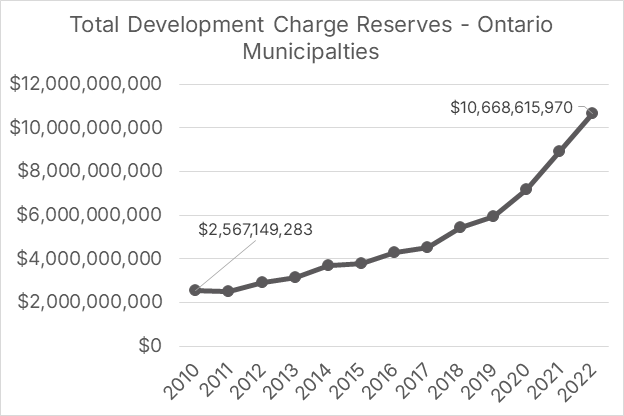

7. High housing taxes have left billions of unspent dollars

Municipalities in Ontario have collected billions of dollars in development charges, but have not spent a significant portion of it. This lack of spending was not part of the plan to allow reserves to accumulate and fund larger infrastructure projects. On average, for every dollar of forecasted spending on infrastructure, Ontario municipalities have only spent 62 cents.

Toronto, in particular, has been hoarding development charge reserves. Between 2007 and 2023, the amount of unspent infrastructure money in Toronto's development charge reserves grew from $172 million to $3.1 billion, a 1,708% increase. Toronto’s DC reserve fund exhibits an abnormal lack of outflow of funds for infrastructure compared to its municipal peers, such as Ottawa, Barrie, and Hamilton.

No one is currently regularly reviewing and auditing infrastructure delivery. There has never been a provincial audit of the current development charges system since its inception in 1997, almost thirty years ago. Although a proposed audit was conducted in 2023, the results of this work have not been publicly released.

8. High housing taxes can be lowered.

Ontario municipalities have alternatives to development charges, including financing projects through municipal debt. Ontario municipalities are increasingly forgoing this option and financing less of their infrastructure through debt and more through development charges.

While saving for projects using development charges may seem financially prudent, it can raise project costs, as construction inflation often exceeds interest rates.

Ontario municipalities can issue debt up to a limit set by the province; however, most municipalities are nowhere near this limit, leaving them ample room to increase their debt. Overusing development charges can be a “false economy,” as it raises project costs and shifts debt from governments to households, who face significantly higher borrowing costs.

There is a whole host of infrastructure categories DCs pay for that come with pre-existing dedicated revenue sources, such as water, wastewater, and parking. These services could easily be financed with debt, as they have a sustainable source of funding to repay the financing.

9. High housing taxes are not inevitable because there are fairer and less expensive ways to pay for infrastructure

Moving costs off will not bankrupt governments or cause other taxes to skyrocket. Although development charge rates are high, only $2.4 billion in development charge revenue is spent annually. The development charge burden is high, not because of the overall dollar amount, but because these expenses are placed on a relatively small pool of new renters and homebuyers.

There are many fairer, less expensive, and more direct revenue streams than development charges. For example, water infrastructure can be funded by establishing municipal service corporations. Roads can be funded through gas taxes, new car registrations, and license plate renewals, while parking garages can be supported by revenue from parking fees and fines. Funding these services out of increased property tax revenue is only one of a suite of options.

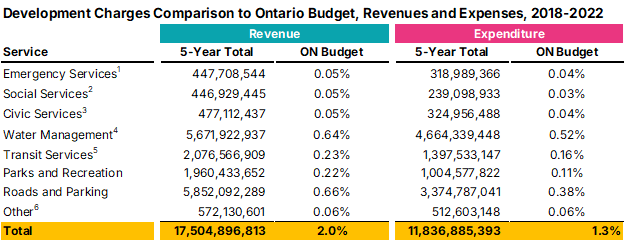

10. High housing taxes pay for more than growth.

The common mantra in defence of development charges is “growth should pay for growth,” but much of the development charge revenue is spent on projects that have a dubious, at best, connection to growth. These initiatives include the renaming of public squares, the establishment of safe injection sites, and the provision of long-term care beds. Most of these initiatives are worthwhile, but they have little to do with the costs associated with adding homes to a community.

Development charges cannot be both about ‘growth paying for growth’ and as a funding source for social services that existing residents prefer not to pay for.

Next, a focus on solutions

This series on development charges has largely focused on problems. This was intentional - to solve a problem, you must first understand it. Later this year, we will launch a new series examining how Ontario can reform a broken development charge system. To make that series a reality, we will be growing our team at MMI.

Previous pieces on development charges

Development Charges: 10 Things You Need to Know About Housing Taxes in Ontario

Ontario Development Charges: Everything You Wanted to Know But Were Afraid to Ask

Most Municipalities Don’t Understand that Coke Doesn’t Make More Profit by Charging $1000 a Can

More Cases of Housing Taxes Unrelated to "Growth Paying for Growth

Development Charges are Artificially High Due to Failure to Plan for 1.5 Million Homes

Community Benefits Charges: Everything You Wanted to Know but Were Afraid to Ask

Debt, rather than DCs, can lower the cost of building infrastructure

Download a PDF version of this article below: